AP automation powered by the best two-way sync

Routable’s two-way sync perfectly mirrors your NetSuite instance, making it easy to send thousands of bill payments worldwide while conforming to your workflows and helping you stay compliant.

Routable was built for NetSuite users

less time spent on reconciliation

reduction in tedious AP tasks

reduction in the cost of bill payments

Custom fields support for NetSuite

Routable pulls custom fields and segments from NetSuite and creates bills using your preferred bill form. You don’t need to configure Routable’s settings to see updated fields; as you update NetSuite, so does Routable.

Send faster payments without breaking the bank

Send payments faster with tools like automated reminders, early payments, and flexible payment methods. Routable supports 4 ACH speeds, 8 check speeds, and Instant Payment remittance (RTP).

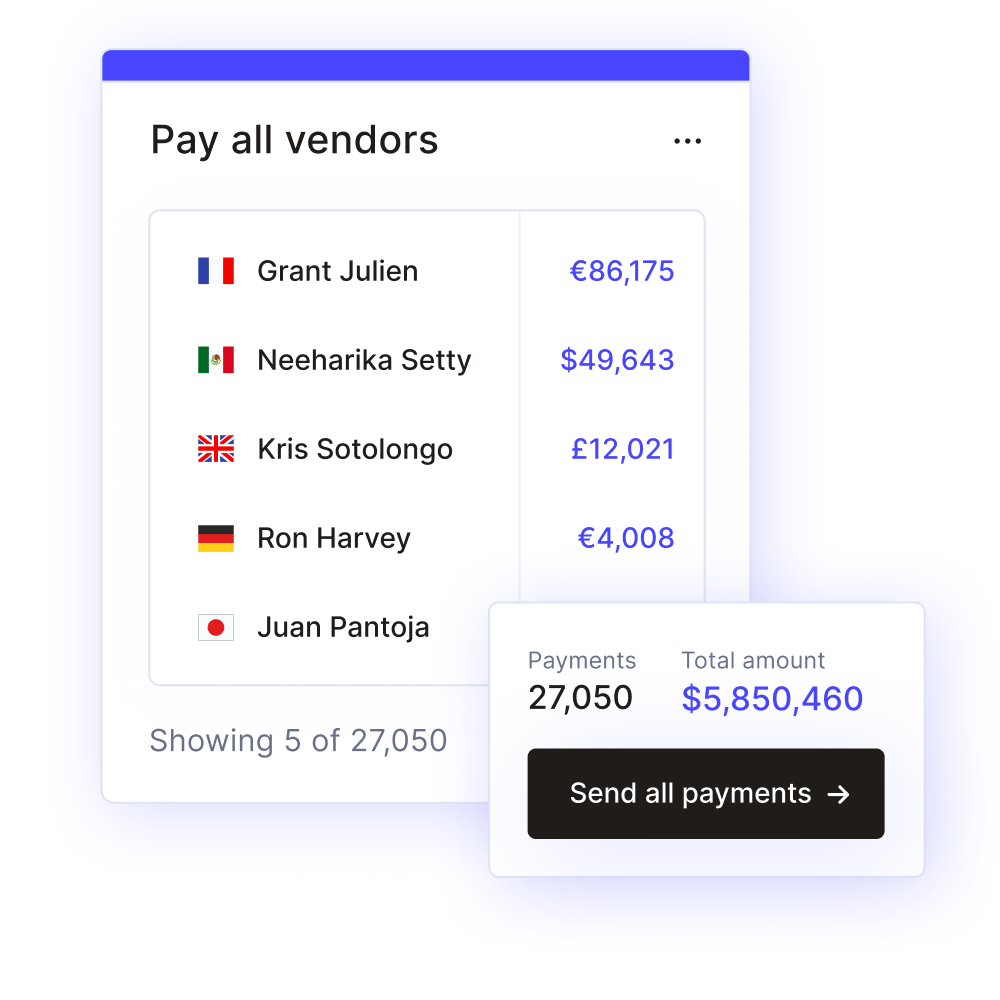

Fast, easy international payments

Send payments to 220+ countries in 36+ currencies in as little as 1-3 business days. Make all your domestic and international payments in one system with complete fee transparency for you and your vendors.

With our real-time two-way sync for NetSuite, both systems are always up to date with the latest transactions and payment statuses so that nothing falls through the cracks. Take advantage of the flexibility to record payments in USD or any of our supported currencies based on your NetSuite preferences.

Mass payments

Make thousands of payments fast with our no-code CSV upload, or use the Routable API to craft the payout experience of your dreams.

Power your business with automated vendor and supplier onboarding, a programmatic way to initiate payments, and a two-way sync with NetSuite while scaling your payouts across borders for an optimal payment experience.

Works with OneWorld to support all your subsidiaries

Integrating with OneWorld is a breeze. Shared vendors in OneWorld can be imported to Routable and used across multiple workspaces to prevent duplicate payments and ensure all payments are reconciled.

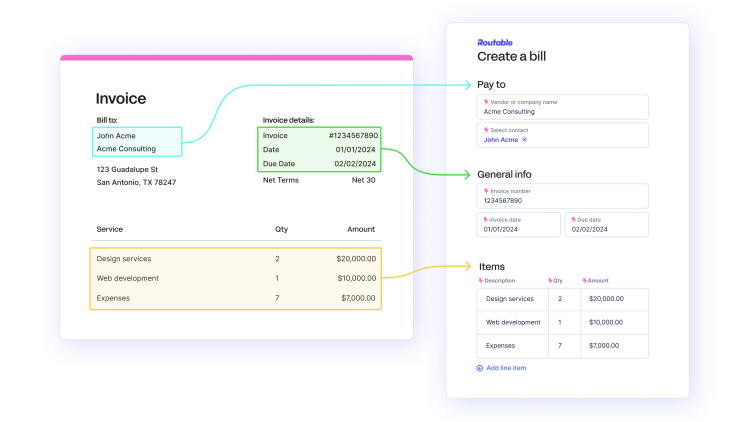

Invoice capture with OCR

Never input a bill manually ever again. Routable eliminates manual data entry and reduces errors with OCR for invoice data capture. Invoices uploaded to the Routable Inbox are automatically pushed into NetSuite in real-time - including PDF attachments.

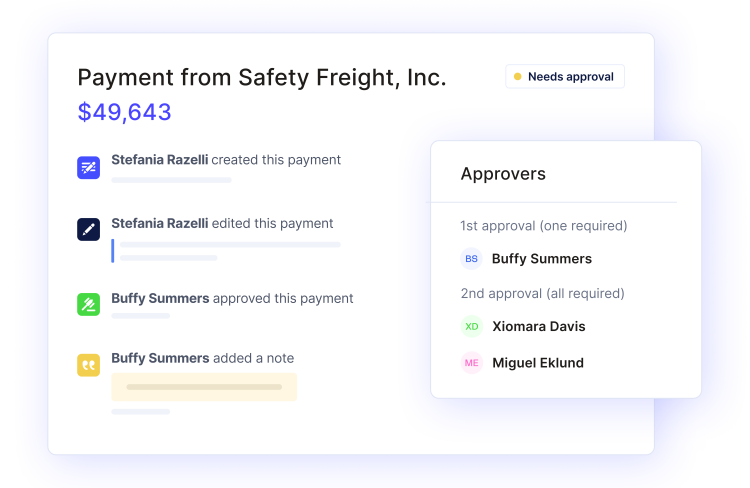

Customizable approval rules

Whether you’re processing 100 or 10,000 bill payments per month, speed up the approval process with flexible approval rules that fit your workflows without sacrificing your compliance requirements.

Our easy-to-use approval builder empowers your Finance team to configure approval workflows based on multiple conditions. Routable supports conditions from NetSuite’s standard fields, custom fields, and custom segments for creating approval rules.

Committed to compliance

Routable ensures ultimate security through access controls, data encryption, key management, and regular application security testing.

Routable works with an independent audit firm to provide an unbiased view (in the form of the SOC 1 Type 2) highlighting what controls Routable deploys to sustain financial data security and integrity across the Routable service and our integration with NetSuite.

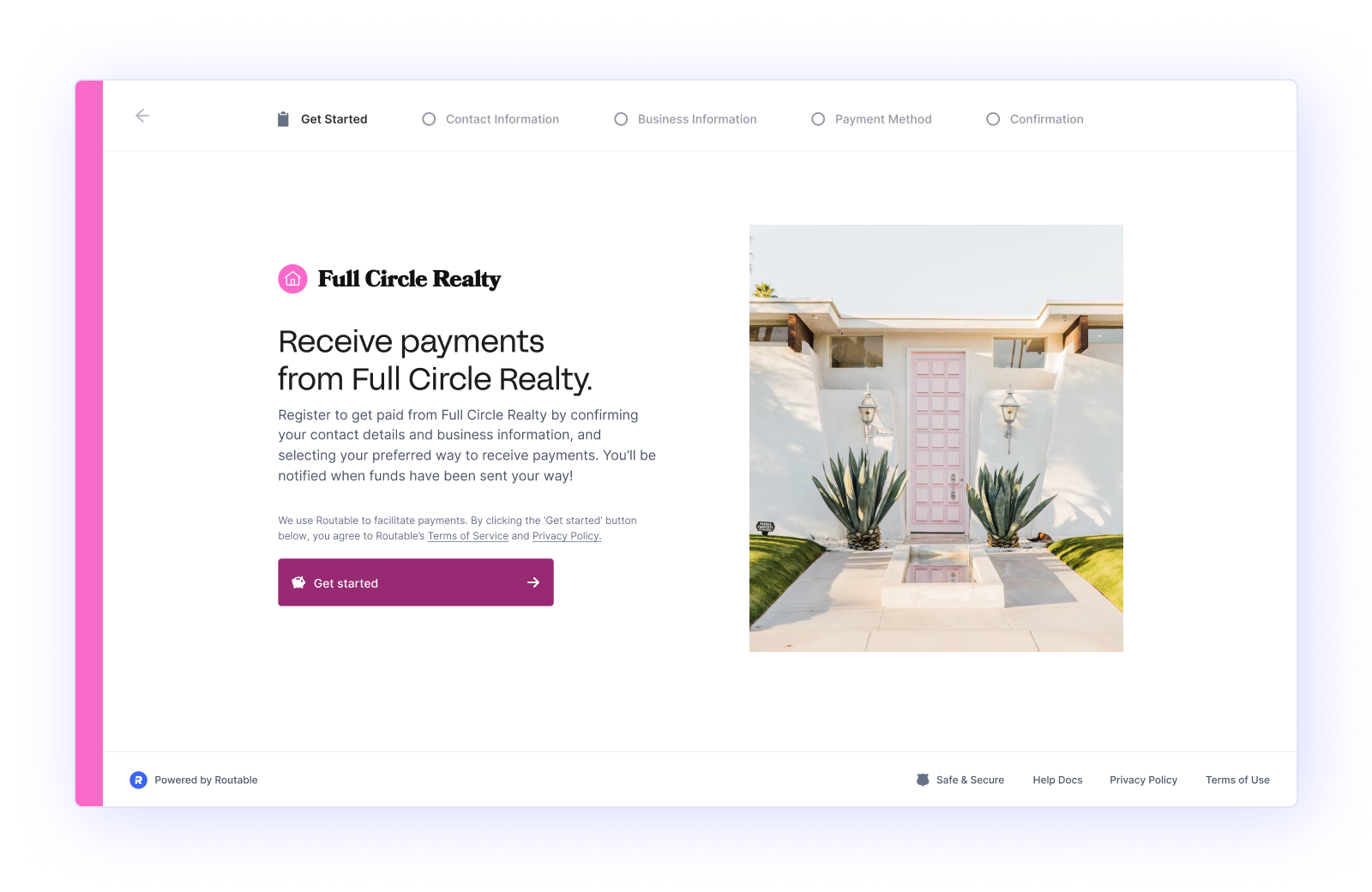

Easy vendor management

Seamlessly onboard domestic and international vendors in a custom-branded onboarding flow with no vendor sign-up required.

Routable stores all of your vendor information, including payment history, contact information, payment preferences, and tax forms in a single, secure place. Your vendor information gets synced with NetSuite.

“Routable’s integration with NetSuite was the best we evaluated. Their two-way sync and compatibility with custom fields allowed us to completely automate our invoice-to-pay processes.”

How Routable enhances NetSuite

A high volume of invoices are manually uploaded to NetSuite

Onboarding hundreds of vendors is time-consuming

You can’t process hundreds of payments in NetSuite

Freelancers and contractors have to be paid ASAP

You have many systems in use besides NetSuite

Ready to see why Routable is the best AP automation platform for NetSuite?

Schedule a demo with our team below.