Carlene Reyes

Accounting

Why real-time payments help reduce gig worker churn

Instant, real-time payments maintain strong relationships with your gig workers and can prevent them from leaving for the competition.

Accounting

How gig economies can stay ahead of tax season

The gig economy continues to boom and tax season will only get messier if businesses don't plan ahead. Here's the easiest way to get organized.

Accounting

What is a Form 1099-MISC?

1099-MISC forms are used to report miscellaneous income. Learn more about the form and and how recent major changes affect non-employee workers.

International

How does international ACH work?

An international ACH transfer is one way for businesses to send payments globally, and it’s commonly used to pay vendors and suppliers abroad.

International

Are SWIFT payments right for your business?

Learn how a SWIFT payment works, how to pay with SWIFT and whether making payments over the SWIFT network is right for your business.

Accounting

What’s the difference between RTP and ACH payments?

The biggest difference between ACH and RTP is the processing speed of each payment: RTP processes instantly whereas ACH can take hours or days.

International

What’s the difference between ACH and SWIFT?

These two common payment methods offer consistent and secure experiences for vendors, but there are clear differences between the two.

Getting Started

What are KYC and KYB and why do they matter?

Learn the basics of KYC, how KYB is related and tips on how to make the process go smoothly at Routable.

International

A guide to cross-border payments

This guide offers an overview of cross-border payments, including examples, the step-by-step process, common challenges and more.

Company News

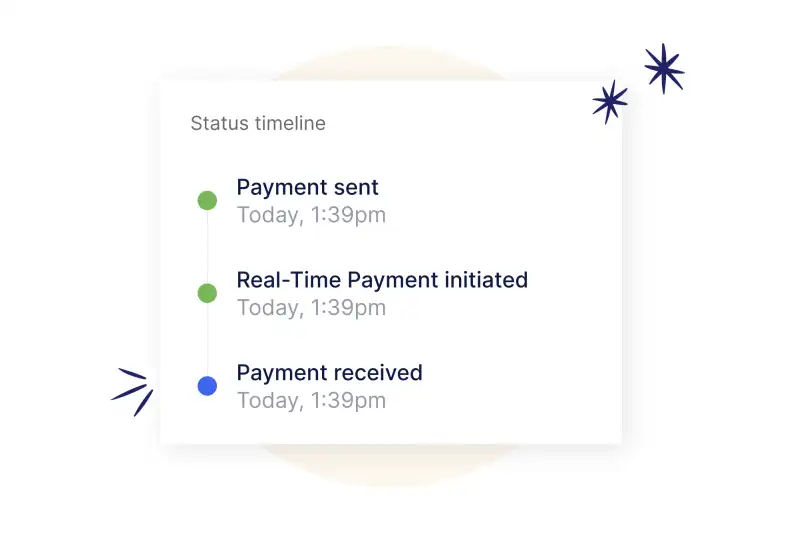

Routable Launches Real-Time Payments (RTP®) to Enable Instant Payouts at Scale

Routable announces the launch of Real-Time Payments (RTP®) to allow businesses to securely pay vendors and contractors within seconds.

Accounting

How OCR technology accelerates your AP process

OCR invoice processing is one of the must-have technologies for a fully automated AP department. Learn the benefits and how to get started.

Accounting

Webinar recap: Finance tech stack done right

Explore best practices for evaluating a change in your current setup, selecting the right tools and getting top-level buy-in.

Routable family of trademarks are owned by Routable Inc. All other trademarks appearing on this website are the property of their respective owners.

By clicking on some of the links on our website, you will leave the Routable website and be directed to an external website. The privacy policies of the external website may differ from our privacy policies. Please review the privacy polices and security indicators displayed on the external websites.

We, and our third party partners, automatically collect certain types of usage information when you visit our Sites, read our emails, or otherwise engage with us. We typically collect this information through a variety of tracking technologies, including cookies, Flash objects, web beacons, file information and similar technology (collectively, "tracking technologies").

Routable is a financial technology company. Banking services for the Routable Balance are provided by partner banks and held for the benefit of our customers. Payment services are provided by our partners. Find a full list of our partners along with their contact information, regulatory registrations, and disclosures on our sub-processors page. Or contact Routable anytime here. Some payment services are provided by Visa, Inc. and subsidiary The Currency Cloud Limited. Registered in England No. 06323311. Registered Office: The Steward Building 1st Floor, 12 Steward Street London E1 6FQ. The Currency Cloud Limited is authorized by the Financial Conduct Authority under the Electronic Money Regulations 2011 for the issuing of electronic money (FRN: 900199). In the US Currency Cloud operates in partnership with CFSB. CFSB fully owns the bank program and services are provided by The Currency Cloud Inc.