In today’s digital economy information is transmitted in real time. So why is it that business payments are subject to standard operating hours, processing windows and cut-off times? Until now, business payments have lagged behind the speed at which businesses operate.

Earlier this year, Routable introduced our latest payment method Real-Time Payments (RTP), to enable businesses to send instant payments at scale to vendors and contractors. With RTP, funds are remitted directly to a recipient’s bank account, available for use within seconds. The best part of it all? By delivering immediate payments for goods and services, businesses are able to expand their partner networks and improve vendor retention to scale their business.

In this blog post, we’ll cover the advantages of using RTP and how you can get started.

What is RTP?

Real-time payments are payments that occur instantly, directly to a recipient’s bank account. Businesses and individuals can send and receive payments 24/7, and funds are immediately available for use by the recipient.

An RTP is completed through the RTP® network, which is monitored by a banking association and payments company called The Clearing House (TCH). Any federally insured depository can join the RTP® network without a membership to TCH. RTP first launched in 2017, and it’s widely accepted by 61% of U.S. banks, including most major banks with adoption increasing each day..

The benefits of RTP

-

Delivery speed. Funds are sent, received and available for use in the recipient’s bank account within seconds.

-

Availability. An RTP can be processed 24/7/365, including weekends and holidays, with no cut-off times.

-

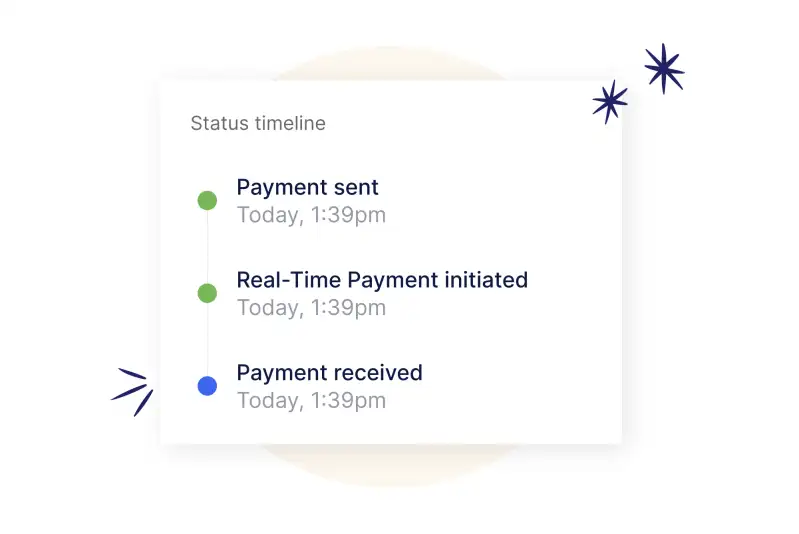

Transparency. Immediate payment confirmation and rich remittance data to streamline reconciliation and ensure both parties are always aware of payment status.

-

Improved control of cash flow. RTP transfers are cleared and settled within seconds, providing increased cash flow visibility for you and your vendors.

-

Partner satisfaction. Vendors and contractors will appreciate the speed at which funds arrive in their accounts.

How to send RTP with Routable

Routable makes sending Real-Time Payments a breeze. To send a payment using RTP:

-

Create a payable. Select “Real-Time Payment (RTP)” as your delivery method.

-

Check your account balance. This is important to ensure that account balance has sufficient funds to complete the payment.

-

Select the recipient’s bank account. Bank accounts that are eligible to receive Real-Time Payments will show as “RTP-enabled.” If your vendor does not have an RTP-enabled bank account you will not be allowed to complete the transaction.

-

Add custom remittance data. You’ll have the option to add up to 140 characters of custom remittance data at no cost. Adding remittance information (such as invoice or purchase order numbers) will help both parties ease the reconciliation process by creating a relationship between payment and the purpose of the payment.

That’s it, you’re ready to send! Once the payment is sent, recipients will receive a payment confirmation via email within a matter of seconds.

Sending RTP at Scale

Real-Time Payments aren’t just for one-off transactions. Routable has designed its system to facilitate large-scale RTP operations, catering to businesses of all sizes.

REST API integration

Routable offers a robust REST API that allows businesses to seamlessly integrate RTP capabilities into their existing software systems. This API enables automated payment initiation, status tracking, and reconciliation. Developers can easily incorporate RTP functionality into custom workflows, making it possible to send thousands of instant payments with minimal manual intervention.

CSV uploads

For businesses that prefer a more straightforward approach or don’t have the resources for API integration, Routable provides a CSV upload feature. This allows companies to batch process multiple RTP transactions by simply uploading a formatted spreadsheet. This option combines the speed of RTP with the familiarity of spreadsheet-based operations, making it accessible to a wide range of users.

Flexibility in creating payout experiences

Whether using the API or CSV upload, Routable’s platform offers extensive customization options. Businesses can tailor the payout experience to their specific needs, including custom notifications, branded payment confirmations, and detailed reporting. This flexibility ensures that RTP can be adapted to various business models and customer experiences.

Comparison with other payment methods

RTP vs. ACH transactions

While ACH (Automated Clearing House) has been a staple of electronic payments, RTP offers several advantages:

-

Speed: RTP is instant, while ACH can take 1-3 business days.

-

Availability: RTP operates 24/7/365, whereas ACH is limited to business days and has cut-off times.

-

Irrevocability: RTP transactions are final, reducing the risk of chargebacks or reversals.

-

Rich data: RTP allows for more detailed remittance information to be sent with the payment.

Advantages over traditional payment methods

Compared to other traditional methods like checks or wire transfers, RTP offers:

-

Lower costs: RTP is generally less expensive than wire transfers and more cost-effective than managing paper checks.

-

Improved security: Electronic transfer reduces risks associated with lost or stolen checks.

-

Better cash flow management: Instant settlement allows for more accurate and timely financial planning.

-

Reduced administrative burden: Automated processes and instant reconciliation save time and reduce errors.

Use cases for real-time payments

Depending on your industry, RTP can benefit you in the following ways:

-

Gig Economy: Platforms can pay contractors instantly upon job completion, improving worker satisfaction and retention.

-

Insurance: Quick claim payouts can enhance customer experience and set companies apart in a competitive market.

-

Real Estate: Instant rent payments or security deposit returns can streamline property management.

-

Manufacturing: Just-in-time payments to suppliers can optimize supply chain operations.

-

Professional Services: Law firms, consultancies, and freelancers can receive payment immediately upon service delivery.

Specific scenarios where RTP excels

-

Emergency payments: When time is critical, such as urgent supplies or disaster relief funds.

-

Last-minute payments: Meeting payment deadlines without delay penalties.

-

Cash flow optimization: Businesses can hold onto funds until the last possible moment before paying, maximizing working capital.

-

Weekend or holiday transactions: When traditional banking hours would cause delays.

-

International business: Although currently limited to U.S. banks, RTP can facilitate quicker payments for international companies with U.S. operations.

-

Customer refunds: Instantly refunding customers can significantly improve satisfaction and loyalty.

Get started sending Real-Time Payments

RTP is available to all Routable customers sending instant payments to U.S.-based vendors. Curious on how RTP compares to ACH transactions? Download our guide, Why Real-Time Payments Beat ACH.