Finding ways to make secure payments to vendors will always be a top priority for business owners. Check payments maintain the level of security, privacy, and risk management that is beneficial to business processes.

Although there are a variety of B2B payment methods available – from ACH, to wire transfers, to credit cards – check payments remain a common and reliable payment option for many businesses.

Digital payments make record-keeping options far more accessible than in years past, but many small businesses might not be equipped with the accounting software to easily input digital data. While embracing advancing ACH payments and other forms of EFTs is key for fast business transactions, eliminating entire payment methods while they remain relevant alienates potential viable solutions to key business needs.

Benefits of paying by check

Checks remain a tried and true method of payment with the following benefits:

-

Familiarity. Business can be complicated. Having a process that is tried and true will always hold appeal and comfort. And with new technology, mobile depositing now removes the need to visit a bank to deposit a check.

-

Flexibility. Payments both large and small can be made using a check. Other payment methods can have limits or minimums for use.

-

Security. Checks are made out to a specific payee and often include watermarks or security coating so that they cannot be tampered with.

-

Risk management. Should a check be lost or damaged in transit, they can be cancelled before they fall into the wrong hands.

-

Fraud protection. Tracking information on a check provides a proof of payment for potential future inquiries from a payee.

-

No bank account requirement. Payees aren’t required to have a bank account to accept a check payment. This is particularly helpful for employees who may not be interested in setting up direct deposit.

-

Time delay. What can be a risk can also be a benefit to smaller businesses on tighter cash flow with projects starting and completing simultaneously. Because checks that are deposited take a few days to clear, this provides a business with an opportunity to ensure necessary funds are available.

Routable supports 8 different check delivery options

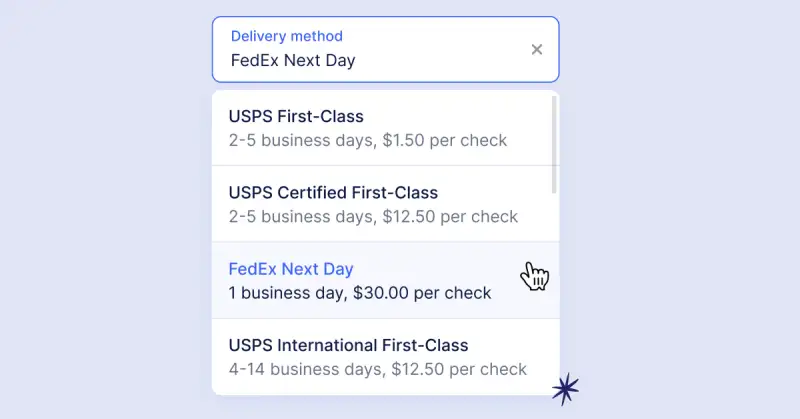

We’re excited to announce we now have 8 new check delivery options available, including international checks, next day delivery, and multiple providers.

-

Even more check payment options. Routable ensures flexibility in payment choices. In addition to a standard USPS First-Class option, there are now options that allow next business day vendor payments, within 2-3 business days, with USPS Certified mail, or with signature requirements.

-

International delivery. Routable offers support for USPS First-Class International mail, for vendors that request checks delivered outside of the United States.

-

Tracking. In addition to USPS Certified First-Class, which gives full chain-of-custody tracking via the USPS, there is also support for tracking on USPS Priority, USPS Priority with Signature Confirmation, and USPS Priority Express. Routable also supports tracking via FedEx, with FedEx Next Day and FedEx Two Day.

-

Personal. Check payments made using Routable are printed with the client bank account and routing information so that vendors know they are receiving payments directly from their client—not a third party—which supports healthy business relationships.

-

**Fast.** Using Routable for check delivery is faster than relying on check orders to process through a bank. Users know that they will never run out of checks to pay vendors.

Finding ways to make secure payments to vendors will always be a top priority for business owners. Check payments maintain the level of security, privacy, and risk management that is beneficial to business processes. Even as digital payment methods make waves in the finance landscape, the use of check payments still remains prevalent.

There isn’t a one-size-fits-all payment method for B2B payments. The best solution is to work with a payment provider that offers more than one payment method so that there are options that meet all your business needs. Choosing a payment provider that offers checks as a payment option can help diversify your payment method options to a larger pool of businesses.

Learn more about our check delivery methods and pricing.