SAN FRANCISCO, July 26, 2022 – Routable, a modern and intuitive business payments platform with a focus on mass payouts, today announced its new Cross-Border Payments solution, which gives businesses the ability to send money to over 220 countries. Routable’s Cross-Border Payments solution enables companies to onboard and pay their growing global network of vendors and contractors, allowing companies to expand their business globally. This is a competitive advantage for rapidly growing companies that are looking for the right global payouts solution to take them from 1,000’s to 100,000’s of payments a month.

“We work with companies that are scaling rapidly, with an increasing need to pay contractors and vendors around the globe,” said Omri Mor, co-founder and CEO of Routable. “This is particularly important for companies in the growing gig economy and marketplace spaces. Now, companies can rely on one seamless payout experience for both their domestic and global payout needs, and continue to grow their network of vendors and contractors – no matter where they are located.”

Key highlights of Routable’s comprehensive Cross-Border Payments include:

-

Simplified global payouts – An intuitive and automated solution for both your domestic and global payouts, eliminating the need for multiple payment systems and complicated workflows.

-

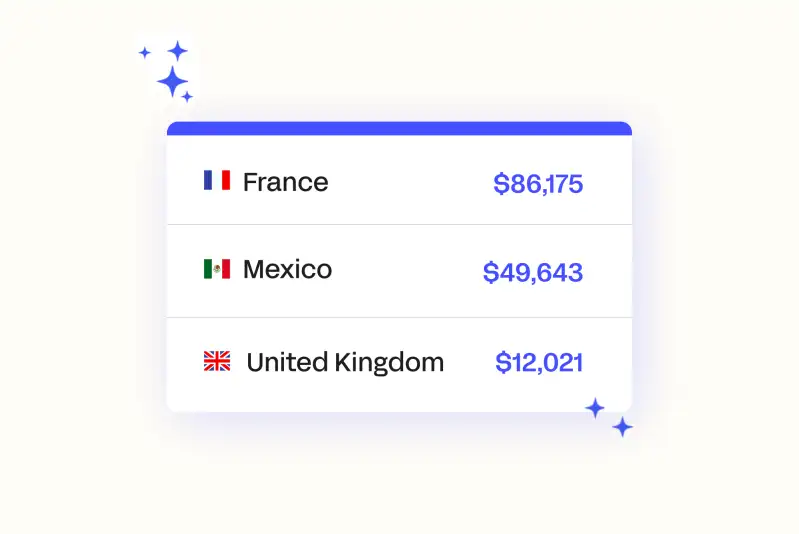

Complete global coverage – Send money to over 220 countries and territories with flexible payment options including International ACH and SWIFT, multiple speeds, and currencies while maintaining full visibility into each payment.

-

Built to support your teams – Deliver the ideal payouts experience for your finance, operations, and engineering teams with multiple options including handling payouts straight from your dashboard, or using a no-code CSV upload feature or build the ultimate payouts experience with a REST API.

-

Real-time, two-way sync into accounting software – Routable syncs your bill and payment details so customers can focus on global expansion. Integration into Oracle NetSuite is available now, with more coming soon.

-

Transform your onboarding process – Onboard your vendors globally straight from your dashboard in seconds.

The majority of traditional cross-border payment solutions are built to support single peer-to-peer cross-border transactions or are only built to handle the traditional AP use case. Routable’s Cross-Border Payments solution supports multiple payment methods and speeds with competitive transaction fees, making it possible for businesses to power global mass payouts at scale.

“Creating a payout experience that keeps our boutiques and business owners happy is essential to our business,” said Sunil Gowda, Co-founder and CEO of Garmentory. “With Routable’s Cross-Border Payments solution, I can now onboard and pay thousands of partners across the globe quickly with multiple options. Having full visibility into the payments process is essential to keeping our community of indie boutiques and designers growing.”

The launch of Cross-Border Payments gives Routable customers access to the industry’s leading B2B mass payouts solution while still offering a simple, flexible and secure payments infrastructure.

For more information, please visit www.routable.com/payables/cross-border-payments/.

About Routable

Routable’s secure B2B payments solution helps finance teams automate and simplify the payables process from invoice receipt to settlement. With support for your existing workflows and the flexibility to scale transactions from 100 to 100,000+, the platform was purpose-built to handle mass payouts while reducing time spent on manual tasks.

Media Contact Claudia Taylor Clarity for Routable claudia.taylor@clarity.global