Finance leaders are always looking to optimize their AP processes and increase operational efficiency. Sage Intacct’s AP automation capabilities offer a complete solution to transform how you manage accounts payable, eliminating manual data entry and streamlining the entire AP process from invoice capture to payment processing.

What is Sage Intacct AP automation?

True to its name, Intacct’s AP automation software automates the accounts payable workflow from start to finish. Unlike traditional systems that require extensive manual intervention, this payable automation solution integrates with your existing Sage ERP system to provide a centralized location for invoice management and payment processing.

AP automation for Sage specifically addresses the challenges finance teams face today, such as manual invoice coding, complex approval hierarchies, and compliance across multiple legal entities. By implementing this accounts payable automation system, organizations can reduce errors and gain more control over business spending.

Intacct benefits for finance teams

The cloud-native architecture of Intacct gives finance teams real-time visibility across the business that traditional systems just can’t. Better cash management and more strategic decision-making.

Intacct’s multi-entity capabilities allow companies to manage complex organizational structures while maintaining a consistent payable workflow process. The dimensional accounting feature provides unparalleled flexibility for tracking and analyzing expenses across different departments, projects, and locations.

Role-based dashboards ensure that each member of your AP team gets the information relevant to their role, so they can work more efficiently and reduce the learning curve associated with new software. Automation’s paperless environment allows accounting teams to focus on strategic initiatives rather than mundane data entry tasks.

Sage Intacct AP automation benefits

Cost savings and measurable ROI

Organizations implementing Intacct’s payable automation solution typically see significant cost savings on invoice processing. Eliminating manual processes means companies can reduce invoice handling costs by up to 80% and see immediate, measurable ROI.

Automation of the AP process dramatically reduces processing time. Invoices move from receipt to payment-ready in days, not weeks. This means your finance team can reallocate their time to more strategic activities that add more value to the business.

Improved accuracy and compliance

One of the biggest benefits of automating AP with Intacct is the massive reduction in errors associated with manual data entry. The system’s validation capabilities catch discrepancies between invoices, purchase orders, and receiving documents before they become issues, so fewer exceptions require manual intervention.

Intacct’s audit trail and documentation ensure that your accounts payable operations are compliant with regulatory requirements, including SOX. Every action in the system is tracked, creating accountability and transparency that’s not possible in a paper-based or partially automated environment.

The system’s approval process management enforces proper segregation of duties, another key aspect of financial controls. By defining clear approval workflows with appropriate authority limits, organisations maintain control while expediting legitimate business expenses.

Finance team productivity gains

Companies typically report their accounting teams save dozens of hours a month after implementing Intacct AP automation. The elimination of manual data entry alone reduces processing time by more than 50%, so staff can focus on exception handling and vendor relationship management.

Month-end close processes are much more efficient. Many organizations report a reduction in close time from weeks to days. This is because all invoice data is accurately captured and categorized in the system, so there’s no scramble to find and process last-minute invoices.

Cross-departmental collaboration improves, too, with unlimited users able to access the system based on their role. Departments can submit invoices electronically, track their status, and receive notifications when payment approvals are complete.

Sage Intacct AP automation features

Intelligent invoice processing

Intacct uses advanced OCR and AI to automate the capture of invoice data, reducing the need for manual data entry. The system can extract key information such as vendor details, line items, amounts and payment terms from invoices in any format.

Email integration means invoices can be captured directly from designated inboxes, no printing and scanning required. The system learns over time, recognising vendor specific formats and improving data extraction accuracy with each document processed.The system’s three way matching functionality compares invoice data against purchase orders and receiving documents, flags discrepancies for review. This automation reduces the risk of paying for goods or services not ordered or received as specified.

Exception handling is streamlined through intelligent routing based on rules. When discrepancies arise the system assigns them to the relevant team member for resolution, so nothing falls through the gaps in your accounts payable process.

Approval workflows

Intacct has highly flexible options for creating approval chains that match your organisation’s structure and policies. Approvals can be routed based on department, amount thresholds, vendor, expense category or any combination of these.

Mobile capabilities mean approvers can review and act on pending items from anywhere, preventing bottlenecks when key people are away from their desk. The Sage Intacct app provides a user friendly interface to review invoice details and supporting documents before making approval decisions.

Delegation features allow temporary reassignment of approval authority during absences, while escalation rules mean pending items don’t stagnate when approvers are unavailable. These features ensure business continuity without compromising your control framework.

Compared to other systems Intacct’s approval workflow engine is highly flexible and easy to configure. Organisations with complex approval hierarchies love this flexibility and it can be further enhanced by integration with Routable’s configurable approval sequences for payment processing.

Payment processing

Intacct has multiple payment methods – ACH, checks, wire transfers and more. This gives organizations the ability to select the most appropriate payment method for each vendor relationship, optimising efficiency and cost.

The ACH capabilities provide security, cost and rebate benefits. Many organisations use these electronic payment methods to generate revenue through rebate programs while reducing processing costs.

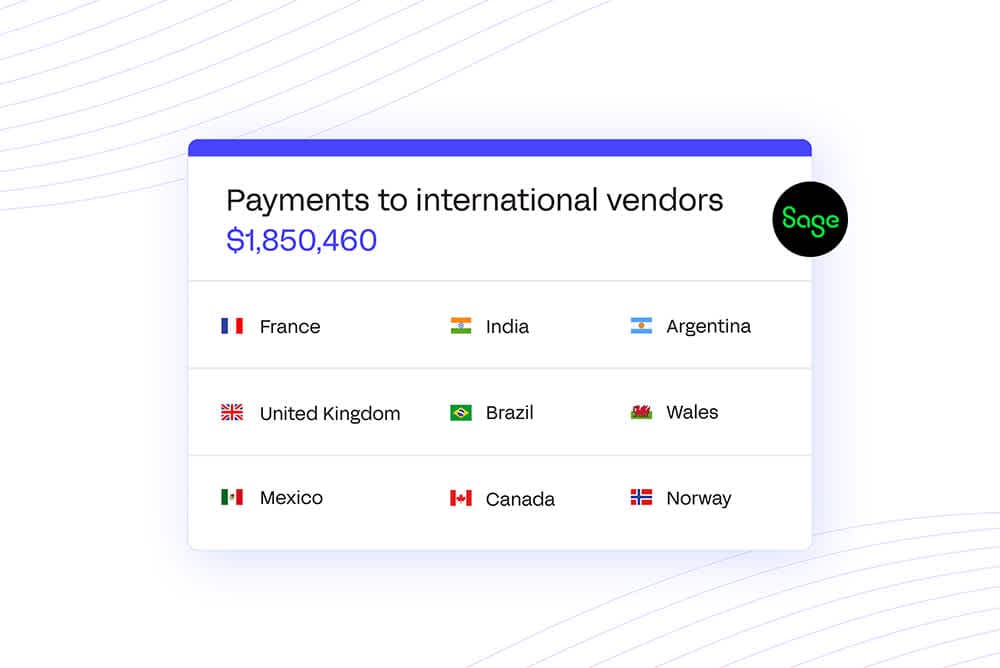

For organizations with international operations, Intacct’s currency handling makes cross border payments and accounting simpler. The system maintains exchange rates and handles multi currency environments with minimal manual intervention.

While Intacct has good payment functionality integration with Routable’s payment network can add even more to your capabilities. This combination delivers an optimal vendor payment experience while maximising your team’s efficiency and minimising transaction costs.

Intacct reporting and dashboards

Intacct has standard reports for accounts payable management. These reports provide real time visibility into aging, cash requirements, vendor activity and other key metrics that drive financial planning.

Custom reporting uses Intacct’s dimensional architecture to analyse data across multiple attributes. This flexibility means finance leaders can examine payables data in the way they manage the business.

Real time analytics dashboards present key performance indicators visually so teams can spot trends and anomalies that would otherwise go unnoticed. This visibility means proactive management of cash flow and vendor relationships rather than reactive problem solving.

The system’s report scheduling and distribution means stakeholders get the information they need when they need it without manual report generation and sharing. This automation keeps everyone aligned across departments and management levels.

Intacct AP automation and your tech stack

ERP and accounting system integration

Intacct integrates with other financial systems, both within and outside the Sage family. This ensures accounts payable data flows to general ledger, cash management and reporting systems without manual intervention.

The platform’s API supports standard and custom integrations with a wide range of business applications. The Intacct Marketplace has dozens of pre-built integrations that address common requirements across industries.

Data synchronisation between systems follows best practice for referential integrity and minimises latency. Two way integration means changes made in one system propagate to the other to maintain consistency across the financial technology stack.

A connected finance tech stack with Intacct at the centre delivers more visibility and control than point solutions. This integrated approach eliminates data silos and provides a single view of financial performance across the organisation.

Banking and payment system connections

Direct bank feed integration automates reconciliation processes, matching cleared payments against the corresponding transactions in Intacct. This automation reduces time for bank reconciliation and improves accuracy.

Intacct’s payment provider network offers a choice in banking partners that fit your organization’s needs. Whether you prefer major national banks or treasury management specialists, compatible options exist.

Bank reconciliation workflows are streamlined with intelligent matching algorithms that can handle large transaction volumes with minimal manual intervention. Exception handling focuses on true issues rather than all transactions.

Document management and storage in Sage Intacct

Intacct has document attachment capabilities that maintain the link between transactions and supporting documents. Every invoice, approval and payment can be attached to relevant documents for easy reference and audit trail.

Search functionality allows users to find invoices and attached documents by various criteria – vendor, amount, date range, approval status and custom fields. No more time wasted searching through file cabinets or shared drives for information.

Compliance with document retention policies is simplified through automated archiving rules. Documents can be retained for the appropriate period based on type, entity or other factors to support operational and regulatory needs.

A unified document management approach integrates accounts payable documents with other financial records for a complete audit trail from purchase to payment. This visibility supports management decision making and compliance verification.

How Routable enhances your Sage Intacct experience

Routable integrates with Sage Intacct to create a powerful end-to-end accounts payable solution that addresses the entire payment lifecycle. This integration bridges the gap between Sage Intacct’s core accounting functionality and the specialized payment processing capabilities that modern finance teams require.

The integration works by synchronizing vendor data, invoice information, and payment details between the two platforms, creating a unified system that eliminates duplicate data entry while maintaining perfect consistency across your financial ecosystem. Key benefits include:

- Streamlined AP workflow: Invoices approved in Sage Intacct can be automatically queued for payment in Routable, creating a continuous process from invoice receipt to vendor payment

- Enhanced payment options: Expand beyond Sage Intacct’s native payment capabilities with Routable’s comprehensive payment options for domestic and international payments

- Reduced payment costs: Intelligently route payments through the most cost-effective methods while respecting vendor preferences