Ramp Bill Pay has emerged as a popular solution for businesses looking to streamline their accounts payable processes, but how well does it actually meet the complex needs of modern organizations? In this comprehensive analysis, we’ll dive deep into Ramp’s bill payment features, examining both their strengths and limitations across key areas like invoice processing, payment management, and compliance.

We’ll also explore how these capabilities stack up against alternatives like Routable, helping you make an informed decision about which platform best suits your business requirements.

Ramp Bill Pay Pros & Cons

Ramp Bill Pay has a wide variety of features

| Pros | Cons |

| Automated invoice data capture and coding | Requires integration setup and maintenance |

| Multiple payment methods in single platform | Limited to domestic and select international payments |

| Basic approval workflows | May require process changes to maximize automation |

| Real-time ERP integration for standard fields | Learning curve for complex approval workflows |

| Built-in cash back opportunities for cards | Tied to Ramp’s broader financial platform |

| Simple vendor portal | Potential vendor resistance to new payment system |

| Error detection and matching | Resource-intensive initial setup |

| Batch payment processing | Limited customization for some payment flows |

Detailed Feature Breakdown

Invoice Processing

Ramp’s core functionality centers around invoice processing and data capture capabilities. This feature automates the manual work of entering invoice details into the system.

Key functionalities include:

- OCR-powered data extraction

- Automated line item coding

- Smart suggestions for GL coding

- Custom rules for invoice handling

Disadvantages

While the AI-powered processing is powerful, it faces several limitations. The system may struggle with non-standard invoice formats or particularly complex multi-page invoices. Additionally, the initial training period for the AI can require manual verification and correction, potentially creating temporary additional work for AP teams.

Technical challenges can arise when processing invoices with special characters or multiple currencies, sometimes requiring manual intervention. The system may also face difficulties with handwritten notes or non-digital modifications on invoices.

Payment Management

Ramp’s payment management features allow businesses to handle multiple payment methods and vendor relationships from a single platform.

Key functionalities include:

- Multiple payment methods (ACH, check, card, wire)

- Automated recurring payments

- Batch payment processing

- Real-time payment status tracking

Disadvantages

The payment management system, while comprehensive, has limitations in handling certain complex payment scenarios. International payments may have restricted availability or higher fees compared to specialized international payment providers. The platform may also face challenges with complex payment scheduling requirements or unique vendor payment terms.

From a technical perspective, payment reconciliation across different payment methods can sometimes lead to timing discrepancies, particularly when dealing with check payments or international transfers.

Approval Workflows

The platform offers customizable approval workflows to maintain control while automating payment processes.

Key functionalities include:

- Multi-level approval routing

- Role-based access controls

- Conditional approval rules

- Mobile approval capabilities

Disadvantages

While flexible, the approval system can become complex to manage as organizations grow. Setting up sophisticated approval hierarchies may require significant initial configuration and ongoing maintenance. Users may find it challenging to modify workflows once established, potentially creating bottlenecks during organizational changes.

Compliance & Tax Management

Ramp’s compliance features provide basic vendor management and tax form collection capabilities.

Key functionalities include:

- Vendor information collection

- Basic tax form storage

- Payment audit trails

- Simple user permission controls

Disadvantages

The compliance system has notable limitations in handling complex regulatory requirements. The platform lacks continuous vendor monitoring and comprehensive global watchlist screening, which could expose businesses to compliance risks.

The system may also struggle with complex multi-entity tax scenarios or international tax requirements, often requiring manual intervention or additional third-party solutions.

Mass Payment Processing

Ramp’s platform includes batch payment capabilities for processing multiple payments simultaneously.

Key functionalities include:

- Batch payment uploads

- Basic payment scheduling

- Multi-payment status tracking

- Payment template creation

Disadvantages

The mass payment system shows limitations when handling very large payment volumes or complex payment scenarios. The platform may experience performance issues with extremely large batch sizes and lacks advanced orchestration features for complex payment routing.

Technical challenges emerge when processing diverse payment types within a single batch, particularly when mixing international and domestic payments. The system may also face constraints with complex payment scheduling requirements or multi-entity batch processing.

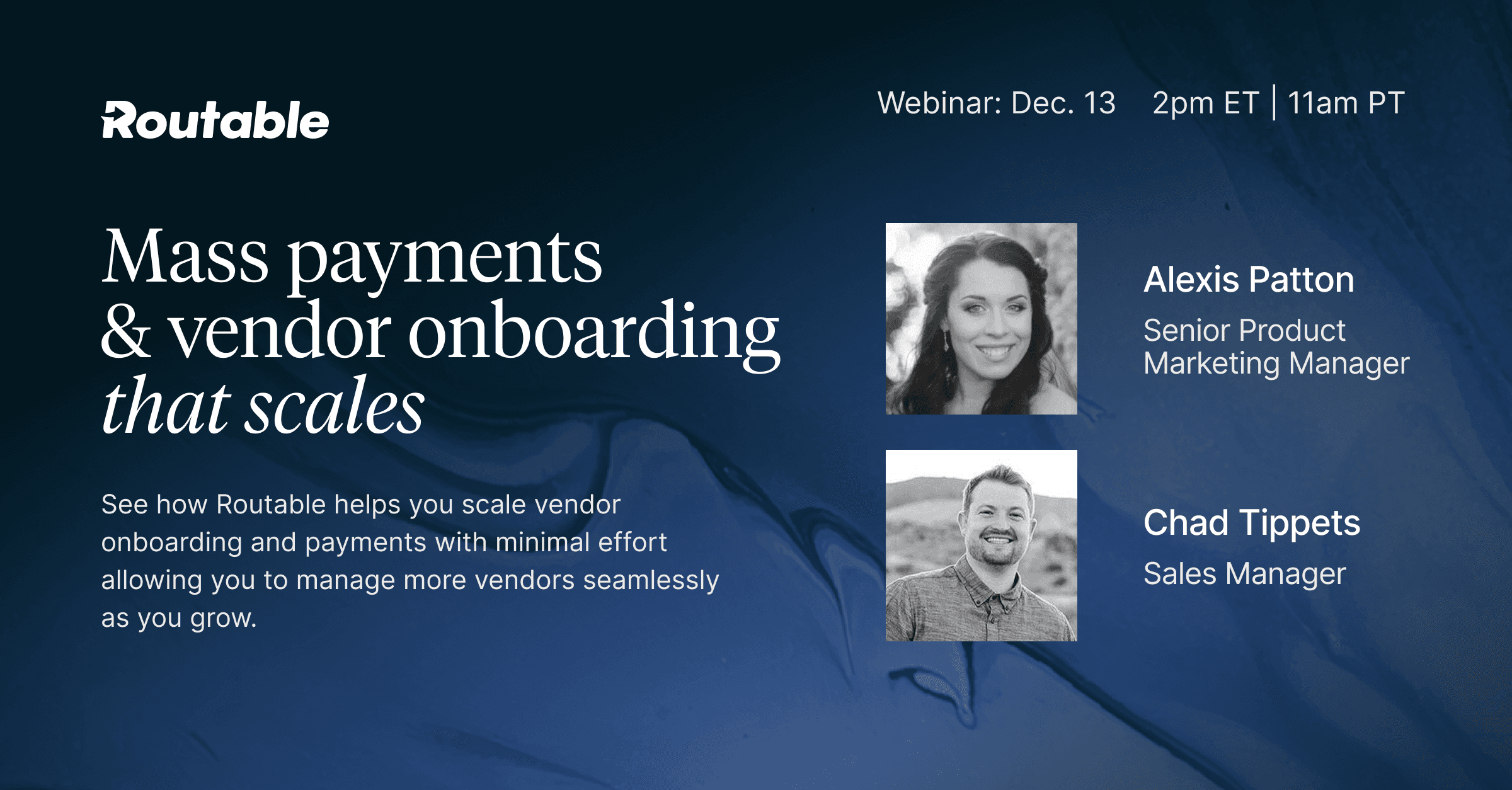

Where Routable Outshines Ramp

Vendor management

Routable offers significantly more robust capabilities through its custom-branded vendor onboarding experiences that maintain your company’s professional image. The platform enables efficient bulk vendor additions through CSV imports or API integration, streamlining the process of managing large vendor networks. Most notably, Routable includes built-in compliance verification checks, providing an additional layer of security and risk management that sets it apart from Ramp’s basic vendor management features.

Mass payment capabilities

Routable demonstrates clear superiority in handling high-volume transactions by placing no restrictions on batch sizes or processing volumes, making it ideal for organizations with extensive payment needs. The platform offers real-time tracking for all mass payments and automates the reconciliation process for bulk transactions, significantly reducing manual oversight requirements.

This unlimited processing capability, combined with automated reconciliation, creates a more scalable solution compared to Ramp’s limited batch processing features.

Comprehensive compliance

Routable’s compliance framework surpasses Ramp’s basic offerings through automated collection and processing of various tax forms, including W-9, W-8 series, and VAT documentation. A standout feature is its continuous monitoring against more than 6,000 global watchlists, providing proactive risk management.

The system delivers automated TIN validation, streamlined 1099 and 1042-S reporting, and maintains detailed audit trails for both compliance activities and payment histories. This robust compliance infrastructure significantly reduces regulatory risk while minimizing manual oversight requirements.

International payments

Routable’s extensive global payment network provides superior international payment capabilities through competitive foreign exchange rates and comprehensive multi-currency support, making it more cost-effective for international transactions.

Routable’s tax compliance capabilities and real-time cross-border payment tracking provide transparency and control that surpass Ramp’s limited international payment features. The platform’s ability to handle complex international tax scenarios and provide detailed tracking across borders makes it particularly valuable for companies with global operations.

Customizable approval workflows

Routable enhances payment control through sophisticated workflow customization options that go beyond Ramp’s basic approval system. While both platforms offer multi-level approval chains, Routable’s conditional routing rules and custom approval thresholds offer greater flexibility for complex organizational structures.

The platform’s role-based permissions are more granular, and its mobile approval capabilities are more comprehensive, enabling efficient workflow management even for organizations with intricate approval requirements.

Summing Up: Why You Should Choose Routable

- Scale: Purpose-built for high-volume payment operations with unlimited batch processing

- Compliance: Comprehensive vendor verification and tax management reduces risk

- Control: Industry-leading approval workflow configurability

- Global Reach: Superior international payment capabilities

- Audit-Ready: Complete payment and compliance audit trails