September 2025

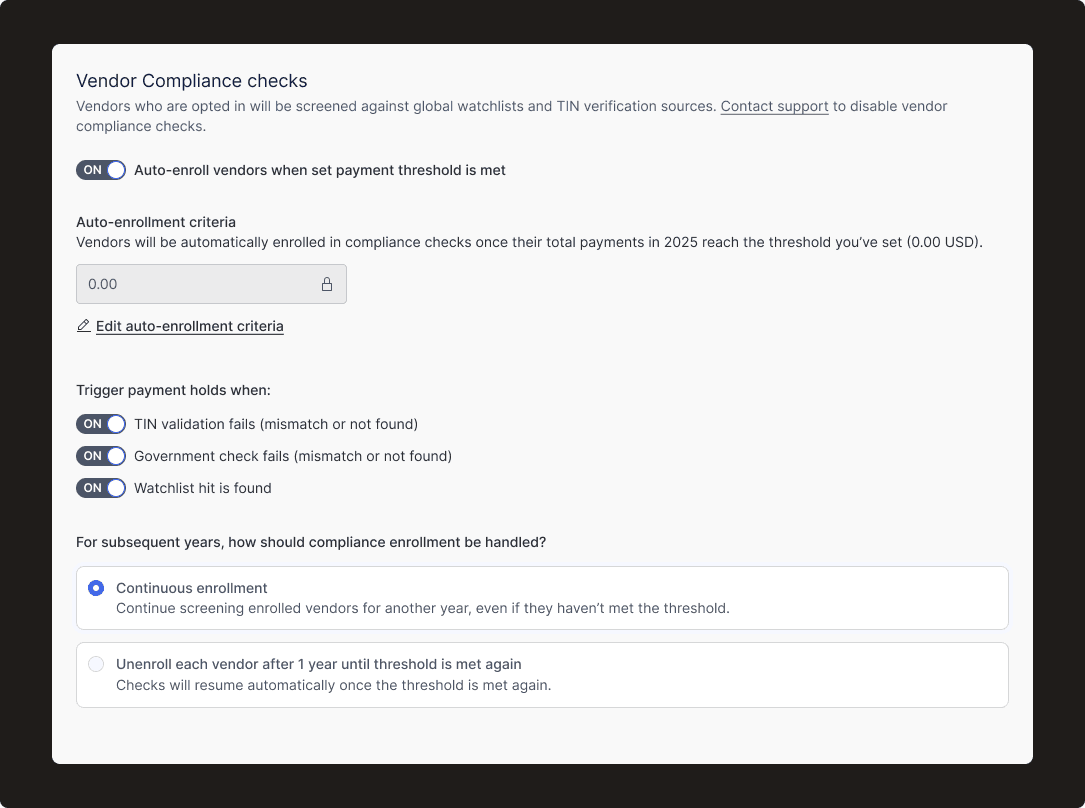

(1) Vendor Compliance Checks enhancements

We’ve rolled out major upgrades to Vendor Compliance Checks, making it easier than ever to manage vendor onboarding and compliance.

-

Targeted payment holds

- Choose when to trigger payment holds based on a variety of compliance flags.

-

Self-guided enablement flow

- Tailor the way you’d like Vendor Compliance Checks to work in your Routable instance with the new, easy-to-use interface

-

Stronger data management

- New fields and more advanced filtering in the Tax Tools Table helps you drill down on the data you need for more robust exports

-

Richer API responses

- New API details above and beyond compliance hold status

- Take a look at our API developer docs for more information

Together, these updates bring you greater control, transparency, and efficiency when managing vendor compliance.

For more information about Vendor Compliance Checks, please visit our Help Center or reach out to Success@Routable.com

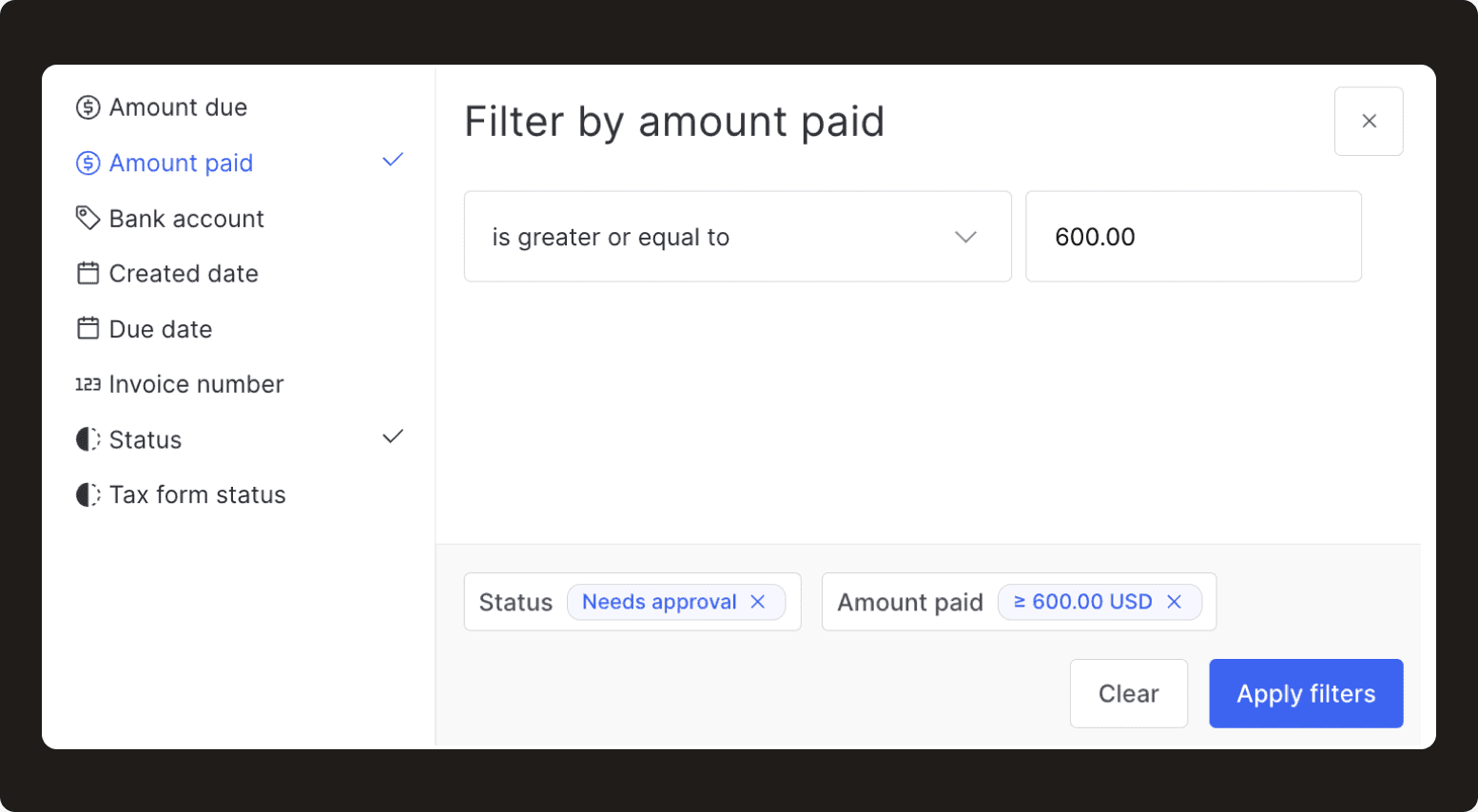

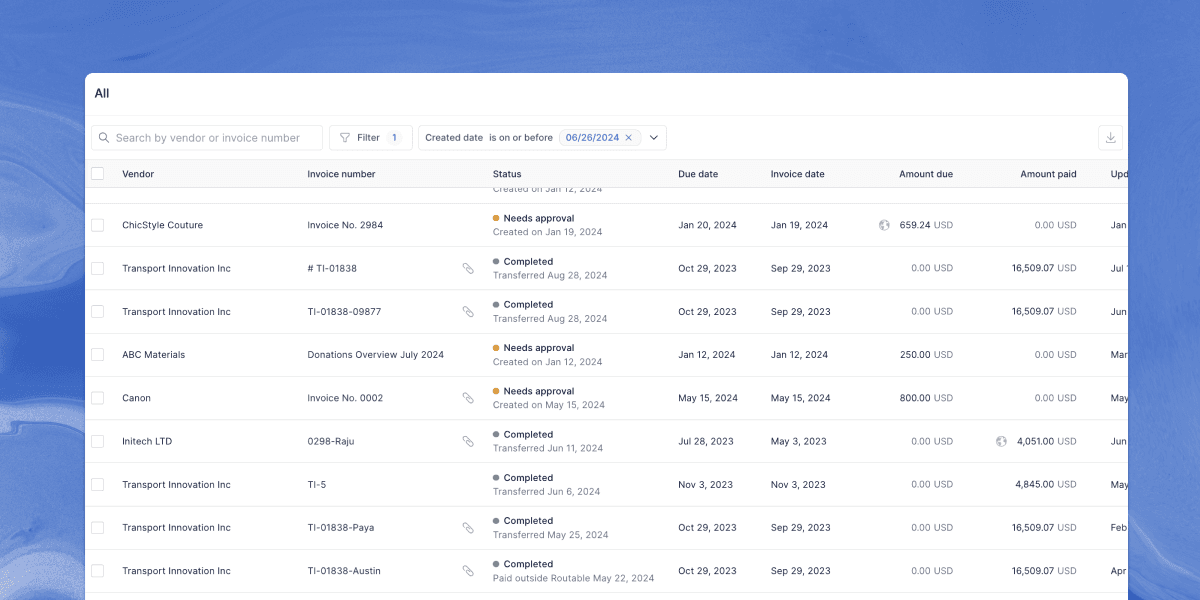

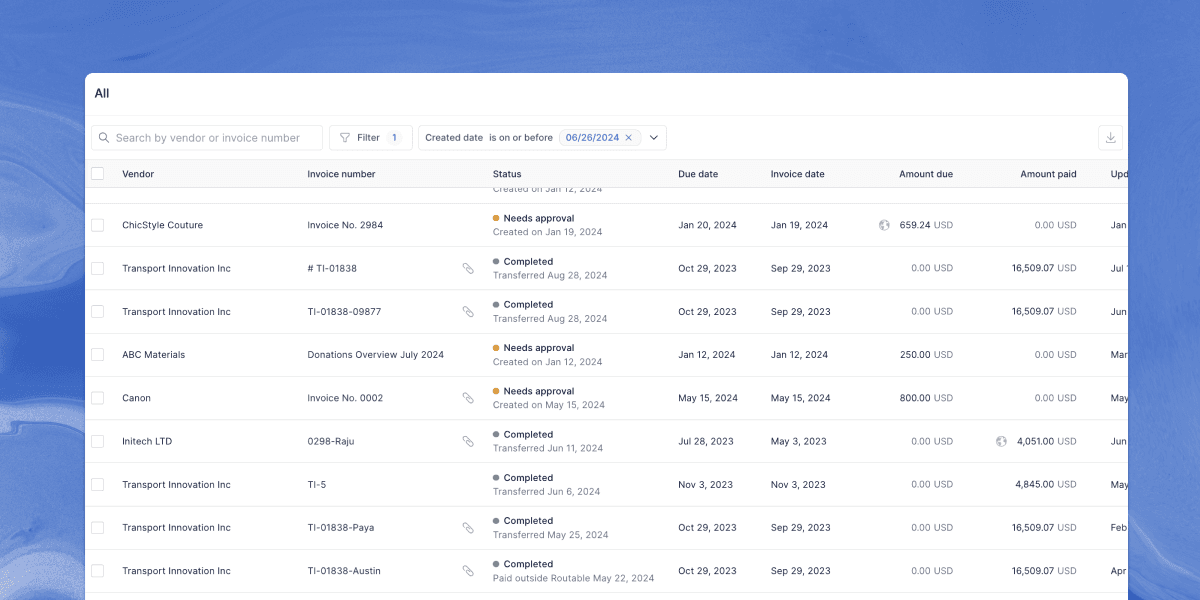

(2) Filter by amount paid

You can now filter payments by Amount Paid, just like you already could with Amount Due. Whether you want to see all payments above a certain threshold, within a specific range, or exactly equal to a value, this new filter makes it simple. It’s now much easier to answer questions like “How much did I pay vendors today?” and to report on payment activity with greater visibility into spend and operations.

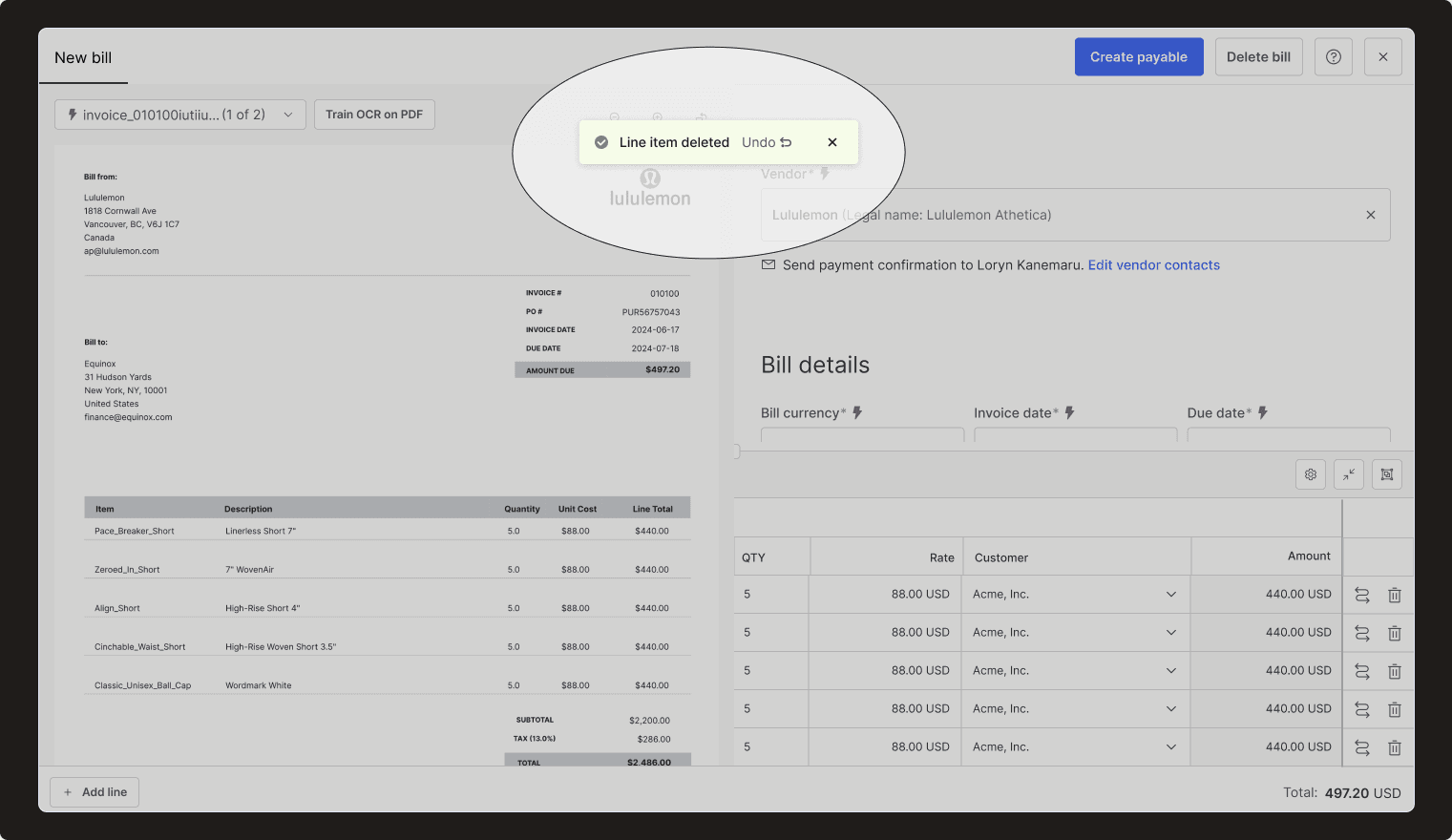

(3) Undo deleted line items

Accidentally delete a line item? No problem. You’ll now see an Undo option whenever a line item is removed, letting you instantly restore it with one click. No need to manually re-enter data.

August 2025

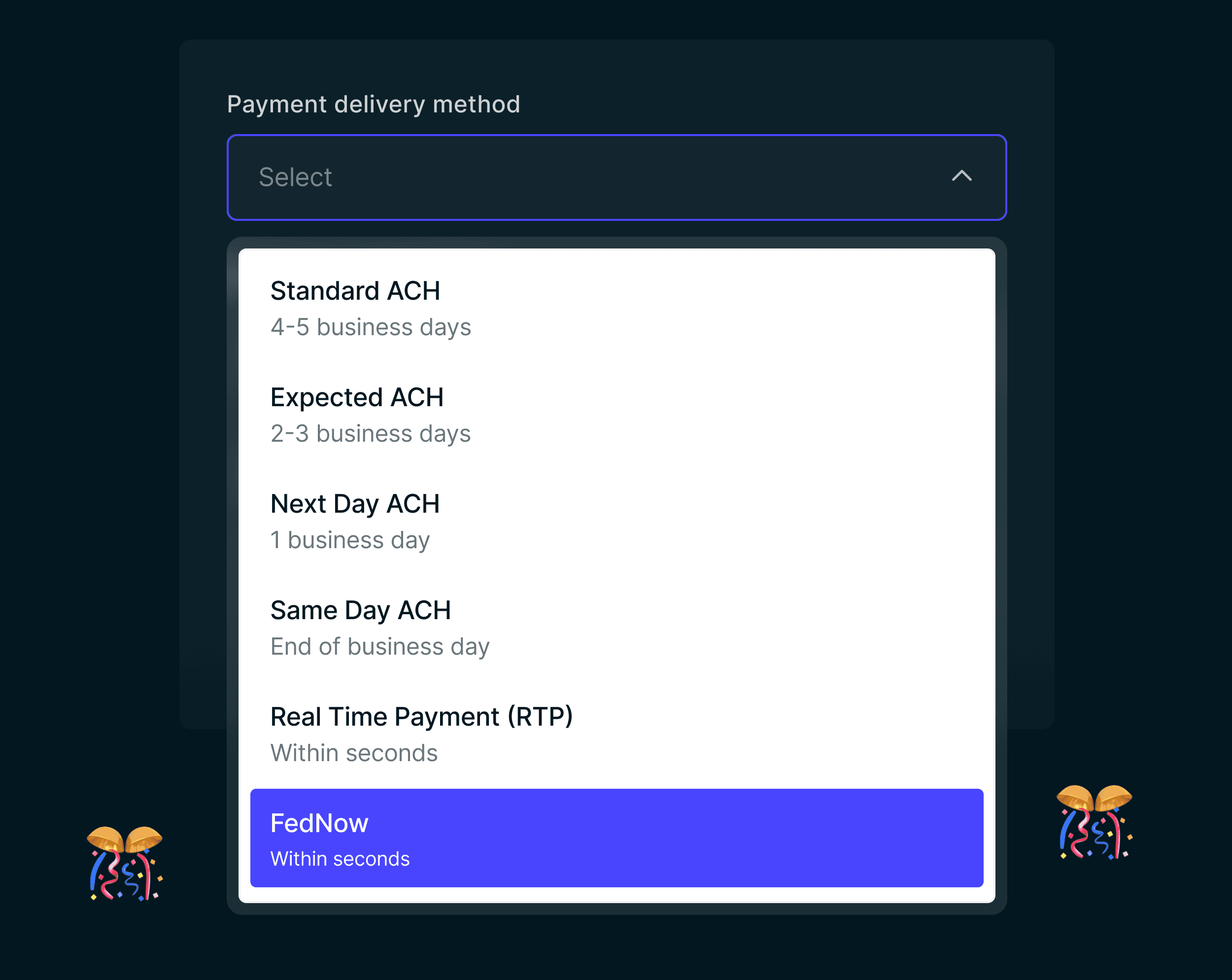

(1) Instant payments with FedNow

We’ve expanded our instant payment capabilities to include banks using the FedNow service. Alongside our existing support for RTP (Real-Time Payments) you now have broader coverage and more flexibility than ever before.

- Reach 85–90% of U.S. bank accounts, including community banks and credit unions not on RTP

- Send more payments iInstantly, 24/7/365—even on weekends and holidays

- FedNow adoption is growing fast, and you’re already connected

No action is needed on your part. This update has been handled behind the scenes by Routable. You’ll just see one simple “Instant” option when choosing a payment method, and we’ll do the work of finding the fastest rail (RTP or FedNow).

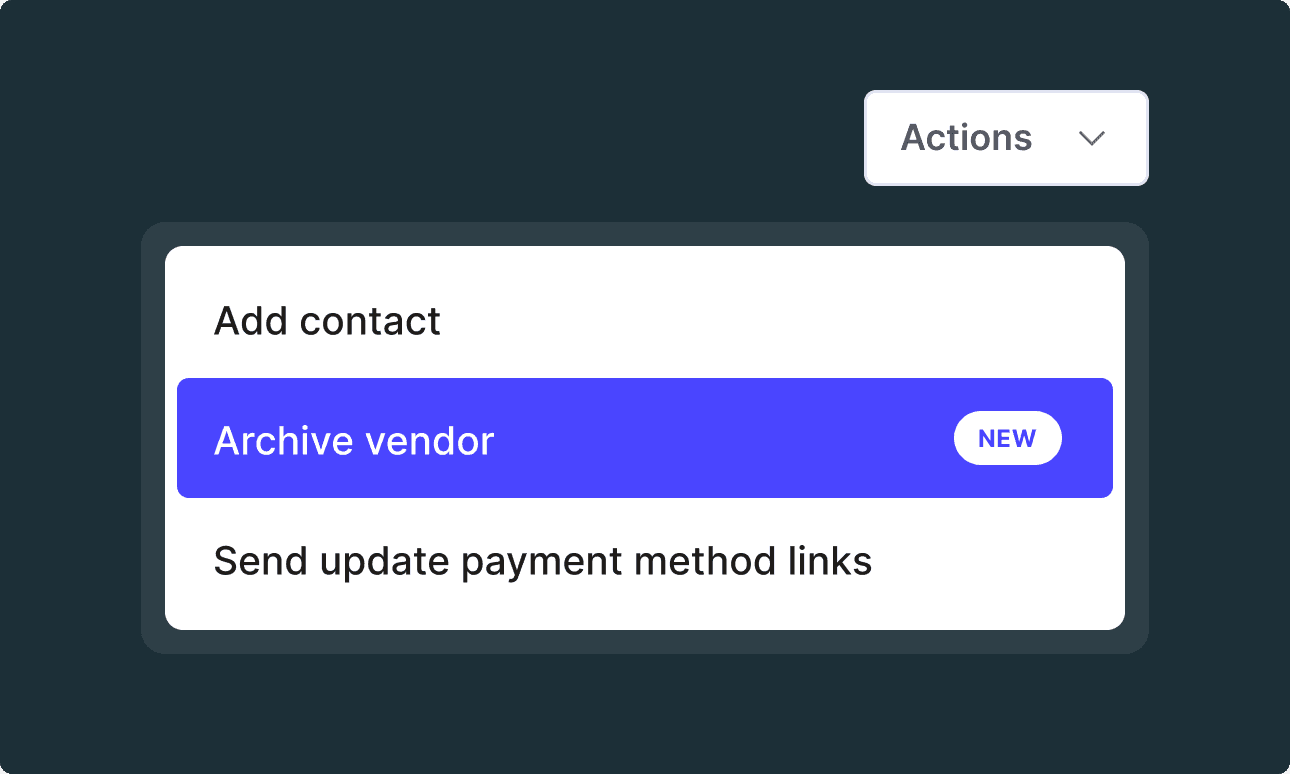

(2) Archive vendor and customer records

You asked, we delivered! You can now archive vendor and customer records directly in Routable.

- Easily remove old or inactive vendors and customers from your day-to-day view without losing historical data.

- Focus only on the partners you’re actively working with, keeping your workspace more organized.

- No need to reach out to support—archiving is now fully in your control.

This is just the first step: we’re also working on expanding support for archived vendor accounts and adding API functionality in the future.

For more information check out our Help Center.

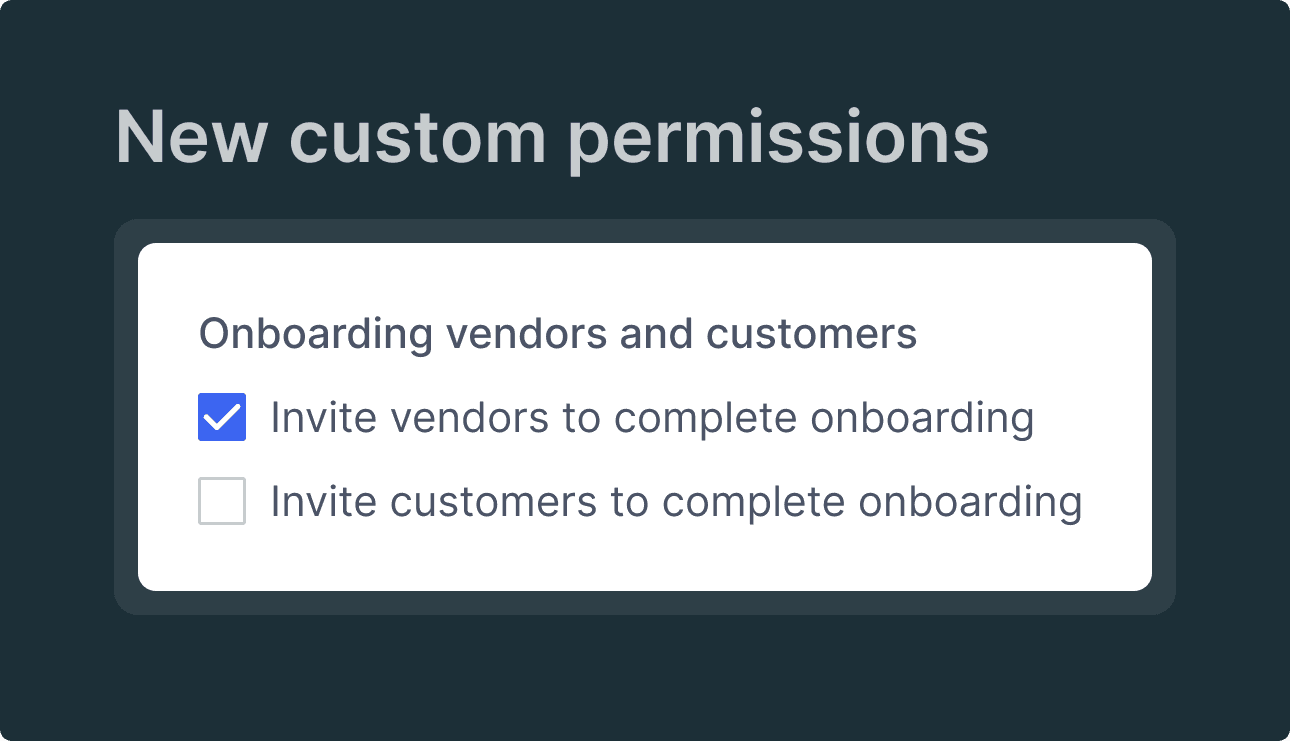

(3) New permissions for vendor onboarding roles

We’ve made it easier to fine-tune your team’s access in Routable. Based on customer feedback, you can now separate onboarding permissions from vendor management.

- Decide who can create or edit vendor profiles, and who can only send or resend onboarding invitations.

- Limit data changes to the right roles, while still enabling your team to move vendor onboarding forward.

- Keep onboarding secure and efficient without slowing down your AP process.

Look for a new “Onboarding” section in permissions where you can enable “Invite vendors/customers to complete onboarding.” Any existing custom roles with permission to “Create” or “Edit” Vendors or Customers will have these new permissions enabled by default.

June 2025

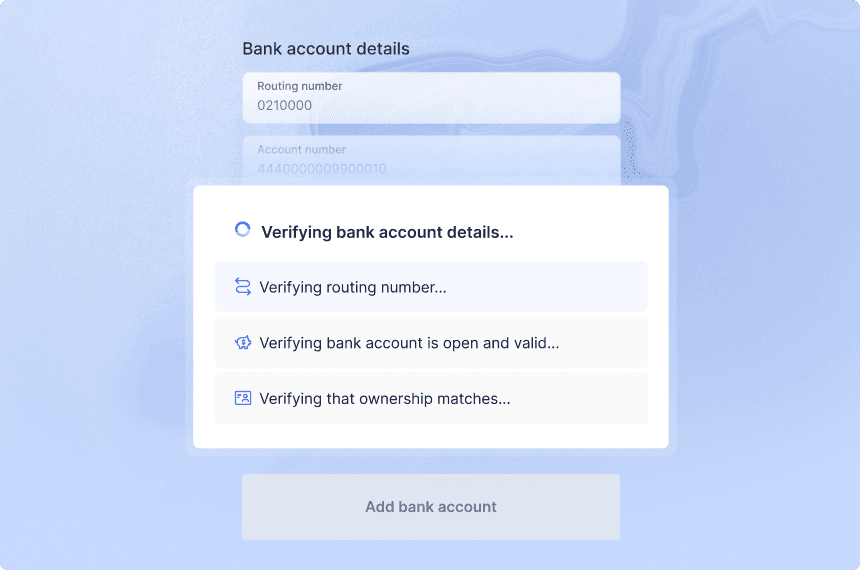

(1) Vendor bank account validation

We’re excited to expand our vendor compliance offering with bank account validation, now available via our API. In addition to verifying tax and TIN details and screening vendors against 6,000+ global watchlists, you can now confirm that bank accounts are open, valid, and owned by your vendors — all before sending a payment. This added layer of validation helps reduce payment issues, strengthen fraud prevention, and improve compliance workflows.

With bank account validation, you can:

- Verify whether a vendor’s bank account is active and able to receive funds

- Confirm ownership by matching the account holder’s name to your vendor records

We’re working to make this feature available for non-API customers soon. If you’d like early access or updates, please reach out to Success@routable.com.

For more information about enabling bank account validation via API, visit our Help Docs.

(2) Clearer approval email subject lines for multi-entity clients

We’ve added the workspace name to the end of the subject line on all approval emails to make it easier for approvers to see which company workspace an approval request belongs to, including individual approvals and digest emails.

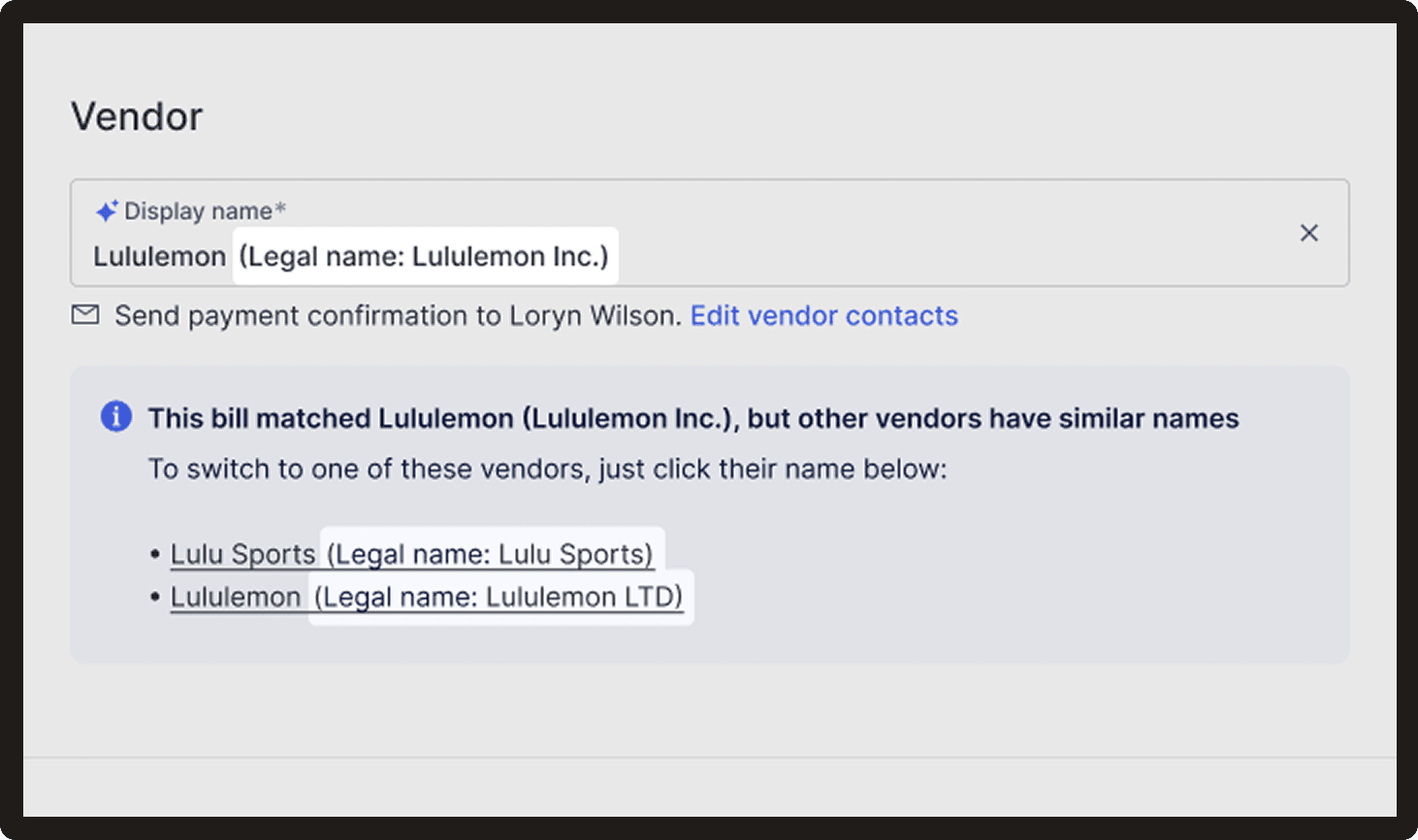

(2) Improved vendor matching accuracy

We’re excited to share several improvements to make your vendor matching more accurate and reliable:

Fewer false positives

Previously, our system compared multiple names found on the invoice to your saved vendors in Routable, which sometimes led to false positives. We’re now identifying the vendor name and comparing only that, so vendor suggestions will be much more accurate.

Coming soon: We’re also adding tracking to measure how accurate vendor matching is, so we can keep improving.

Smarter handling of vendor names in logos

Some invoices include the vendor name only inside a logo or image. Before, these names could show up broken (for example, “The\nSupply\nRoom” looked like just “The”). We now clean up these names properly so they display as “The Supply Room,” improving vendor recognition.

May 2025

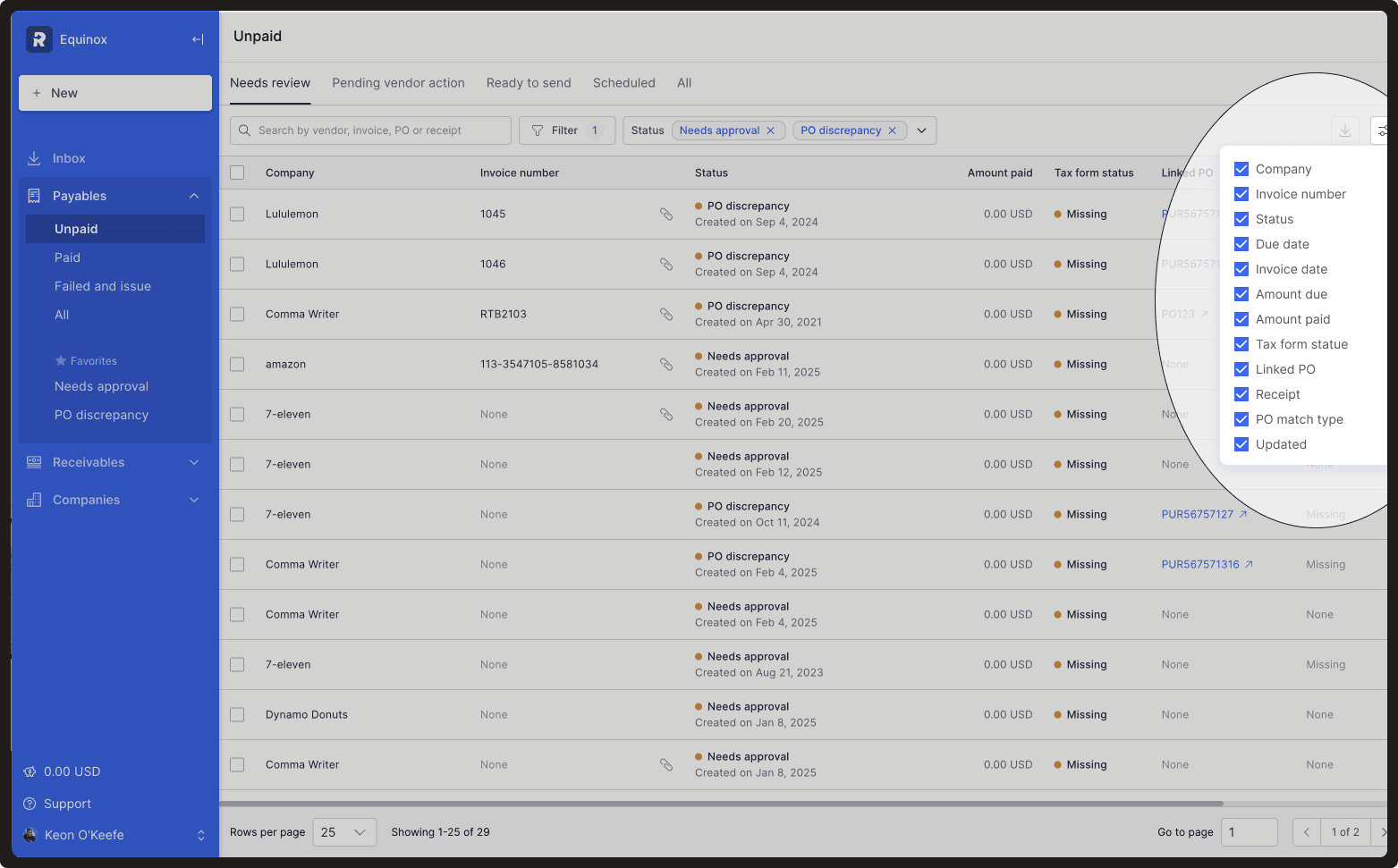

(1) Column picker for Payables list

We’ve added a column picker to the Payables tables, giving you more control over the information you see.

- Choose which columns to show or hide based on what’s most relevant to you

- Your selections are remembered for each tab you visit during your session

Customize your view and focus on the details that matter most—without clutter.

(2) Enhanced vendor matching in AI OCR

We’ve improved how AI OCR matches to vendors in Routable by expanding our matching logic to include the vendor legal name.

Previously, vendor matching was solely based on the vendor display name. Now, the system will also search and match based on the vendor legal name, providing more accurate and comprehensive matching results.

No action needed — the improved matching is live and applied automatically during document processing.

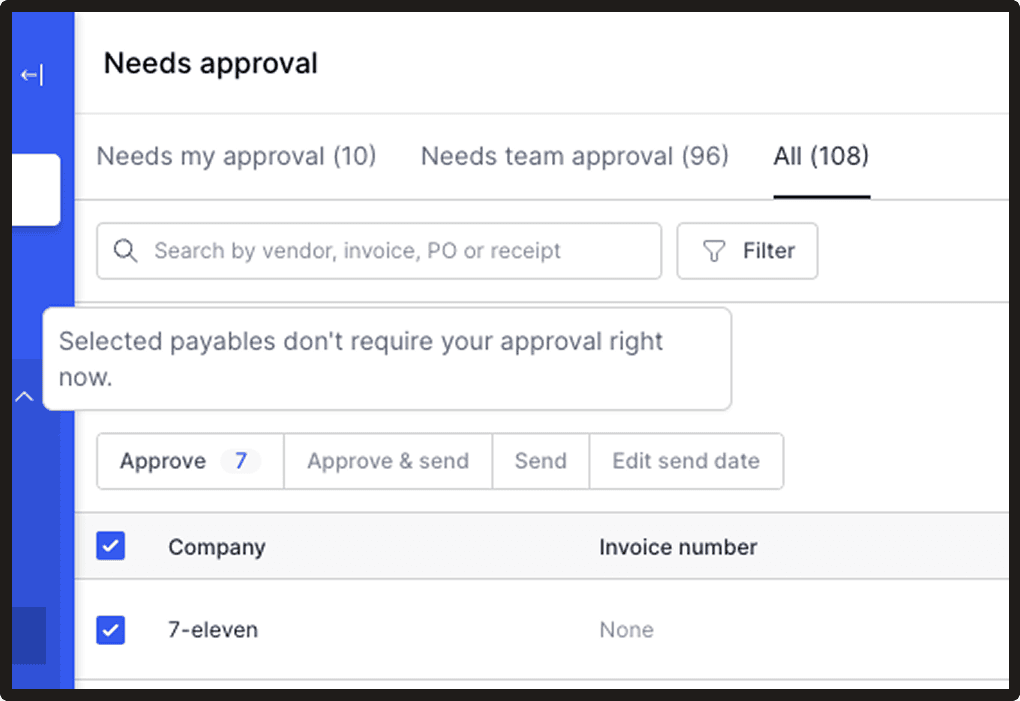

(3) Tooltips for disabled bulk actions

We’ve made bulk action buttons easier to understand by adding contextual tooltips when they’re disabled. This update helps clarify why an action isn’t available, based on selection or permissions.

(4) Smarter PO matching

We’ve rolled out a powerful update designed to eliminate the repetitive work of bill coding for PO-matching workflows. Now, when a bill is linked to a PO, all relevant fields from the PO—from header details to line items—are automatically populated to the bill.

No more copying and pasting—just faster, more accurate bill processing.

(5) Cleaner bulk actions on approval & PO discrepancy tabs

We’ve simplified the bulk action options on certain payables lists by removing actions that are never applicable — no matter the user’s permissions, filters, or the payables’ status.

Removing the non-applicable actions helps reduce clutter and confusion. This is part of our effort to make the experience more focused and intuitive by only showing what’s possible in context.

(6) Improved keyboard navigation in line items table

We’ve made it easier and faster to move through the line items table with your keyboard.

What’s New:

When editing a line item, pressing Enter in a table cell now moves you to the next cell — just like pressing Tab.

This works consistently across all editable input types:

- Text

- Textarea

- Currency

- Number

- Percent

This small but impactful change makes data entry smoother and more efficient for power users and keyboard navigators.

(7) Expanded line item actions for easier access

We’ve improved the line items table to reduce clicks and make frequent actions more accessible, especially for users working with PO matching.

April 2025

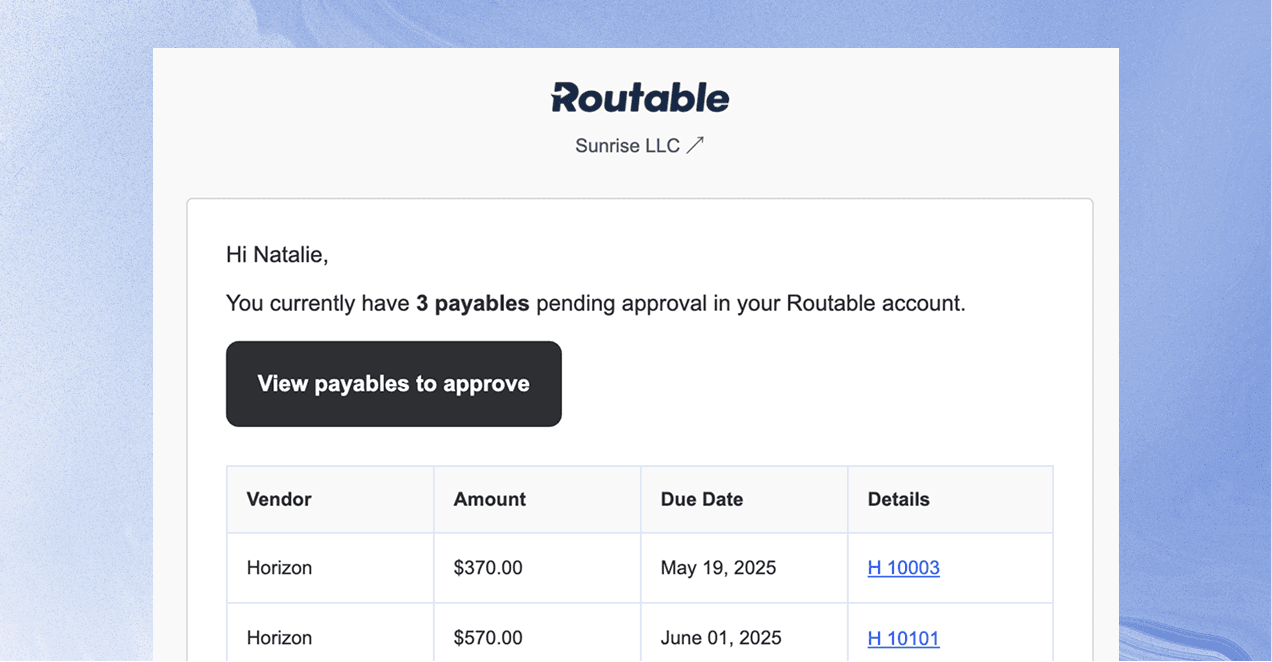

(1) Approval email digest

Bill approvers now receive a daily email summarizing all bills needing their approval. Approvers can then navigate from the digest email into Routable to approve those bills one off, or in bulk.

To individually customize the frequency and delivery time for approval emails, or opt out of them all together.

Simply navigate to Notification settings → Digest emails, then add the day, or days of the week, and time you’d like to receive your email.

Visit the Routable Help Center to learn more

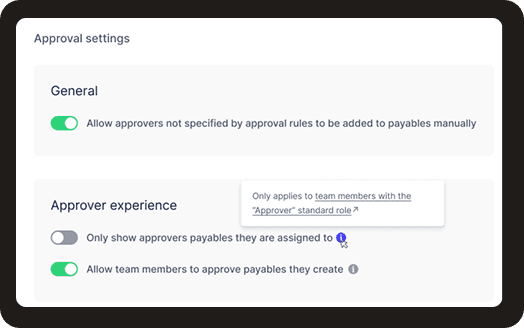

(2) Approvers can see any payables historically approved

For companies with the “Restrict team members to only view payables they are approvers on” setting enabled, approvers will be able to see any payable they historically approved.

We also updated the copy on the setting so it’s more clear!

(3) Additional NetSuite field support

Routable now supports additional list/record types for custom fields for NetSuite. NetSuite’s Country, Customer, and Vendor lists are now available on headers (custom transaction body fields) and line items (customer transaction line fields)

Learn more about configuring NetSuite custom fields in the Routable Help Center

(4) Improved UX in the Messages & History Section

We’ve made a few thoughtful updates to make communication about a payable easier:

- “Note” is now the default tab when clicking into Messages & History, making it easier to send a message to your team without extra clicks.

- Updated tab labels for more clarity between internal notes and vendor messages.

- Better experience when “Reply to Vendor” is unavailable — we’ve improved the disabled state and removed the ability to trigger an error by trying to message a vendor before it’s allowed.

These changes reduce friction, clarify intent, and help avoid confusion when collaborating on payables.

March 2025

(1) Drag and Drop

Now you can drag and drop invoices from your desktop to your Routable inbox!

(2) View CSV and XLS files in the file viewer

View .CSV and Excel files in your inbox along with all of your standard .PDF invoices. Simply upload your files via email, or drag and drop them straight to the inbox!

(3) New look for the statuses of payables and receivables

We’ve improved the visual distinction of payables and receivables, helping quickly identify ones with specific statuses.

- Reduced the number of colors used across statuses

- Grouped the colors for similar statuses together, “Pending”, “Scheduled”, and “In-transit” statuses are all now green

- “Initiated” status is called “In-transit”

- New icons “Processing” and “Queued”, and “Canceled”

(4) New Navigation

We’ve restructured the payables and receivables navigation menu to bring key action items front and center.

“Unpaid” – Quickly access payables that need review or are outstanding

“Paid” – All past transactions or payments in-transit

“Favorites” – Single-click access to payables needing approval

(5) Page improvements

“Needs Review” tab – Quickly access payables that require attention, including Needs Approval, Compliance Hold, and PO Discrepancy statuses as applicable.

Sticky filters – Your selected filters stay in place while you’re logged in, even when navigating away and coming back—so you can pick up right where you left off.

(6) Faster Approvals

“Approve and Next” button – Quickly approve a bill and move to the next one in your queue.

Close button – Quickly return to your filtered payables list with one click.

New Back & Next Navigation – Easily switch between bills without extra clicks.

February 2025

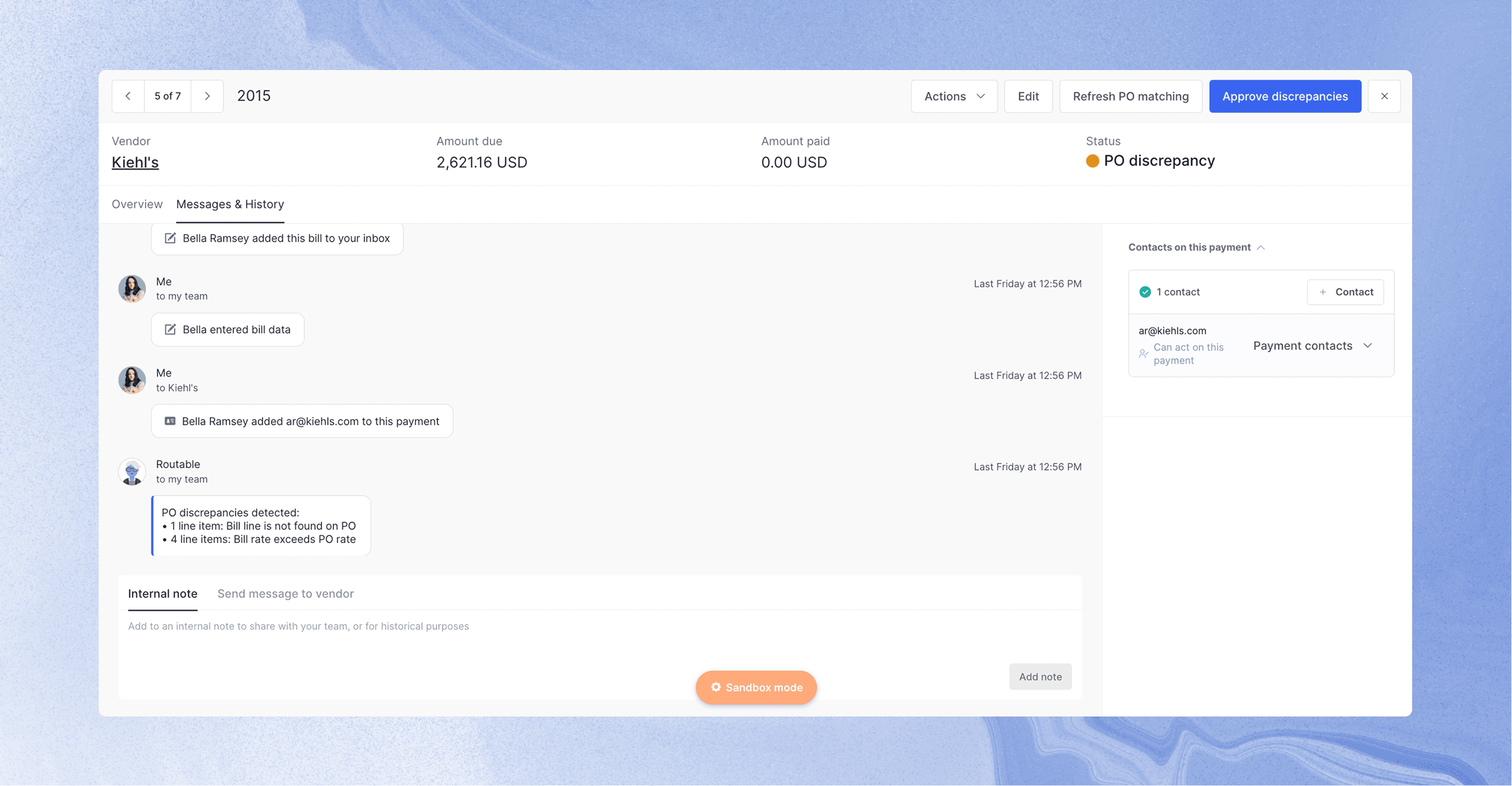

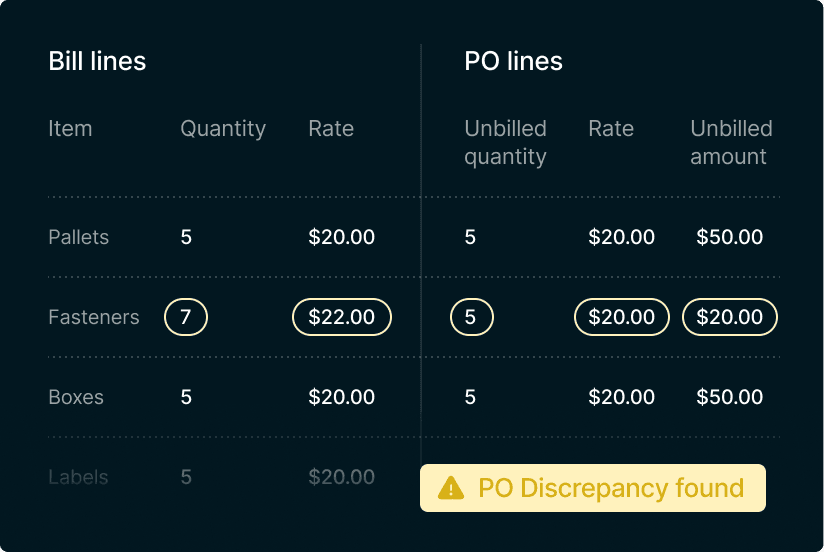

(1) 3-way PO matching

Match, verify, and pay for your purchased goods all while maintaining a complete audit trail with 3-way PO matching- now available for NetSuite customers!

Learn more here, or reach out to Success@routable.com to have PO matching enabled in your account.

(2) Confirm bypass of approval

We’ve recently added more clear dialogue when a Routable user clicks “Bypass approval” during the bill approval workflow. Now users can confirm or cancel, and see summaries of the approvals that will be bypassed.

(3) Use NetSuite Custom Fields & Segments as approval rule conditions

Routable now supports NetSuite custom fields and segments as conditions in approval rules, making designing workflows that meet your unique requirements easier than ever before.

(4) “Updated” column now sorting properly

We’ve addressed a bug in our system that was preventing the “Updated” column in the payables table from properly sorting. Now, that column sorts based on the latest updates to:

- Status changes

- Approvals provided

- Refreshing or approving PO discrepancies

- Edits to the payable

December 2024

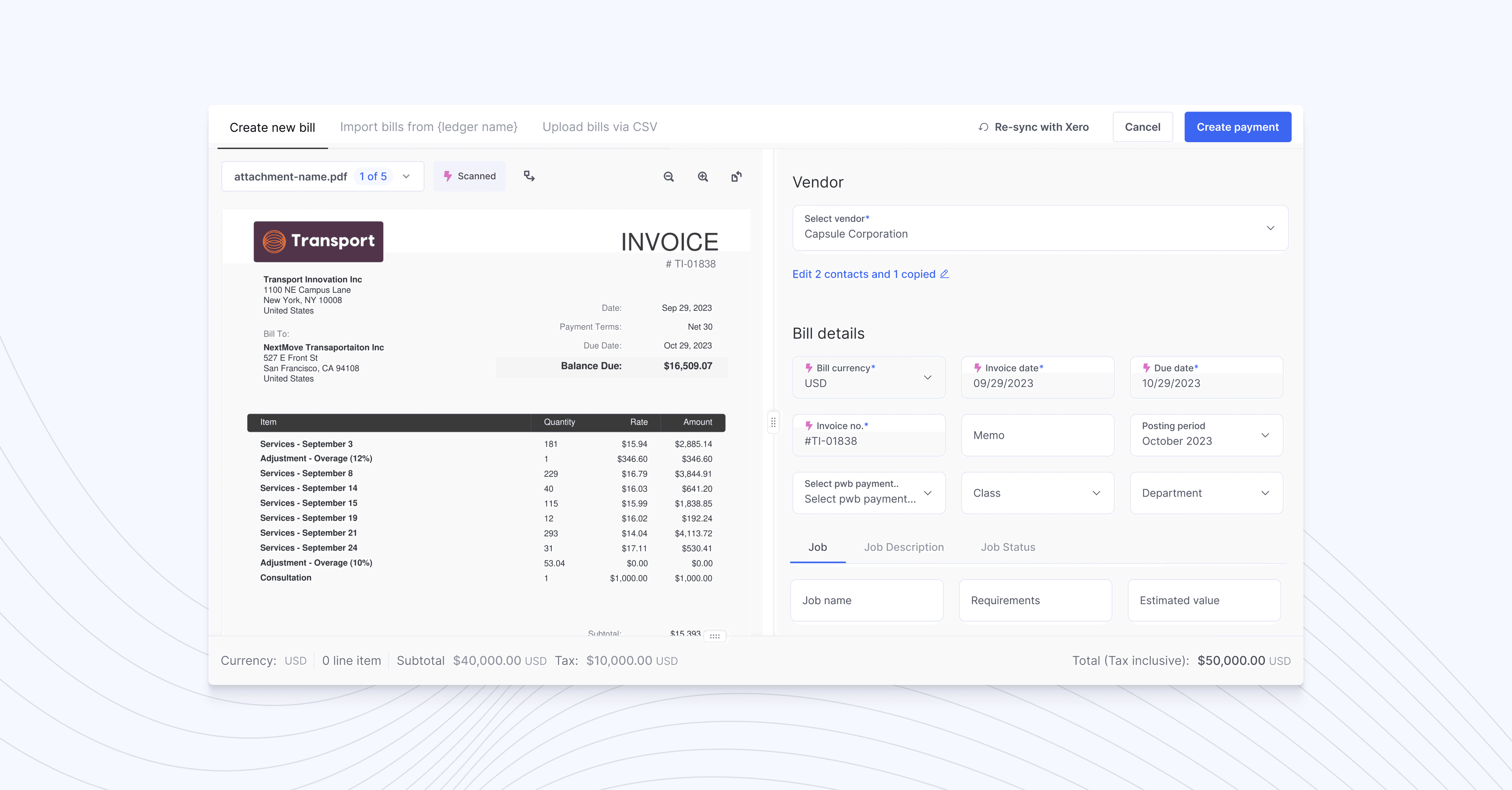

(1) New line item view

Line items can now be viewed in the form on the right side of the PDF viewing area, under “Bill details”, or in the existing expanded full-width drawer along the bottom.

Click “View with full-width drawer” or “View within form” in the line items section to change the line items layout. See it in action.

(2) Tax Improvements

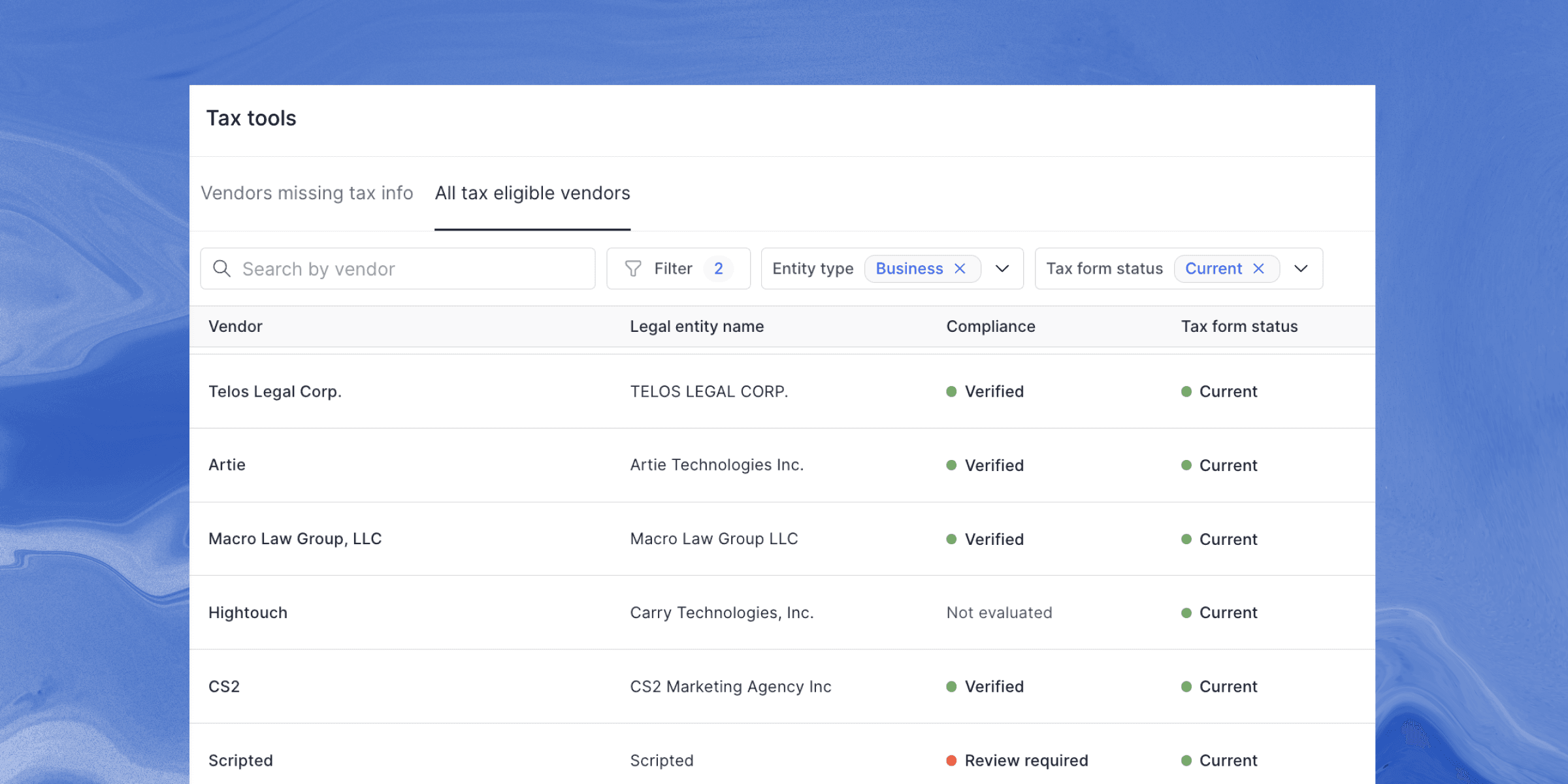

New vendor search and filter functionality

We’ve made some improvements to the tax tools table that make it even easier to see important vendor information. Now, when opening the tax tools table, you’ll see columns for “Legal entity name” and “Business type.”

These updates will help you more easily search for vendors by name (either business name or legal name) and filter through vendors by business type.

This is the first in many updates coming to vendor tax tools. Stay tuned for more!

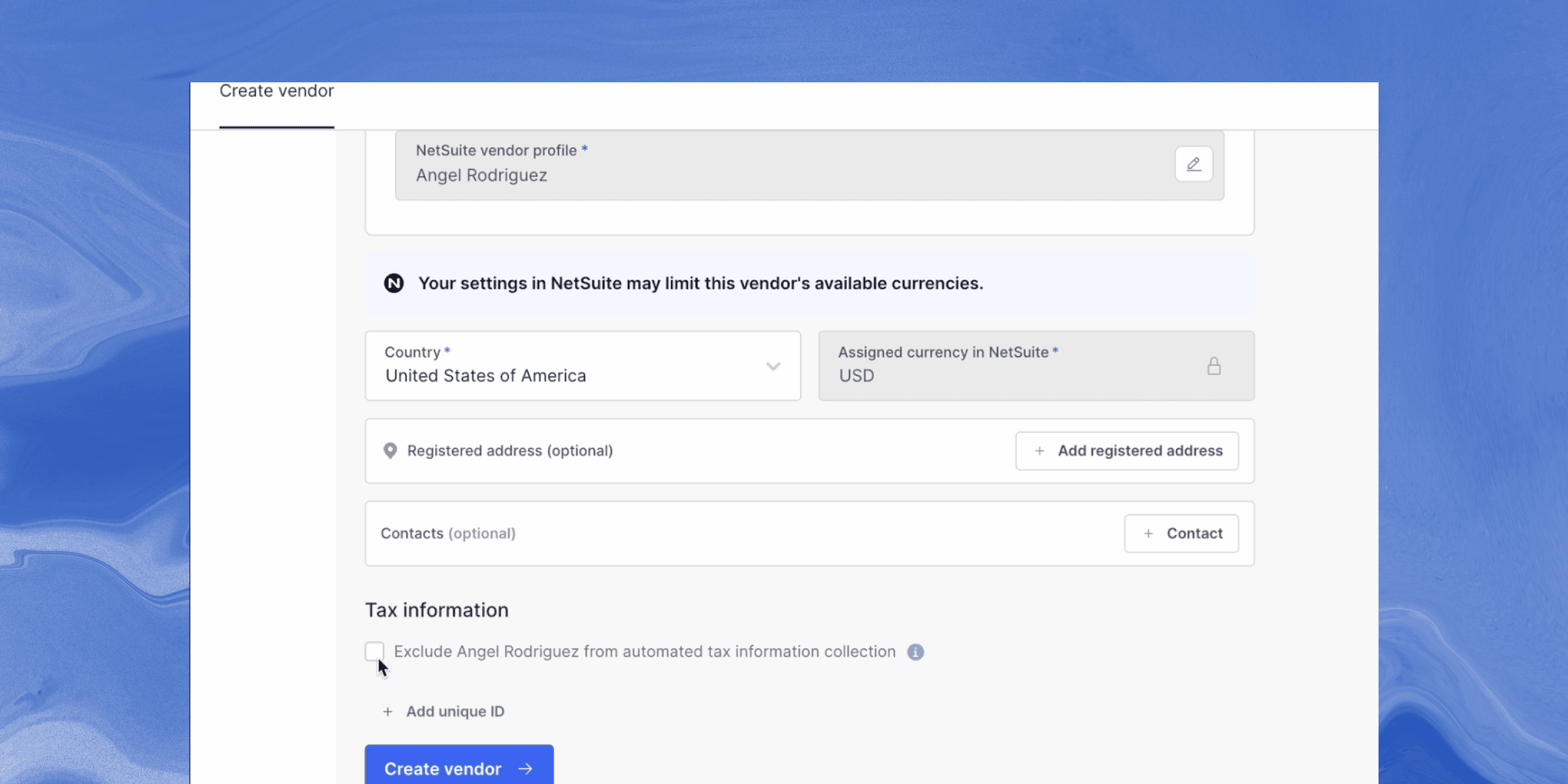

Optional tax form collection

Now you can choose whether or not you want to collect tax information on a vendor by vendor basis. Simply exclude them from that process when creating a new vendor and that vendor will not be asked to provide tax information during the onboard flow.

Simplified international tax collection

Entity type and FACTA status fields have been updated from mandatory to optional fields during your international vendor tax collection process. As these fields do not apply to all international vendors, we believe this will aid in any confusion the mandatory fields had previously caused.

October 2024

(1) New table views

We’ve updated the look and feel of our “Inbox”, “Receivables” and “Companies” tables to match the recent updates made to the “Payables” table.

These updates include new table headers and styling. Plus, this new foundation allows us to include more data in each table, and gives you the flexibility to view only the data that’s most relevant.

🖱️ Added bonus: you can now open links in new tabs from all of our updated tables with the right click of your mouse!

(2) OCR enhancements

We’ve made some updates to the way that our OCR recognizes currencies on your invoices. Now, when scanning an invoice, Routable will more accurately detect and code the currency on the invoice, instead of coding your bill in only your default currency

(3) Better filtering for “Unpaid” tabs

Now when viewing the “Unpaid Bills” or “Unpaid Invoices'” tabs, you’ll have a clear view of all your outstanding bills and invoices.

Payables and receivables in: Needs Approval, Pending, Ready to Send, and Scheduled will now appear in these lists.

(4) NetSuite Memorized transactions removed

We’ve removed NetSuite Memorized transactions from the bills available to import list. We received feedback that because these types of bills are not actionable (even in NetSuite) they were cluttering bill import lists. So poof, now they’re gone!

September 2024

(1) New Payables table view

We’re excited to announce the release of new, faster, and more functional tables.

Each table view under your “Payables” drop down (unpaid bills, needs approval etc.) has gotten a major refresh that includes new filters, styling, headers, and even a new status component. This new foundation allows us to include more data in the tables and provide more flexibility for you to view only the data you want.

Stay tuned for similar updates coming to the “Inbox”, “Receivables” and “Companies” tables.

(2) New due date sorting options for imported bill table

Now when viewing imported bills, you can choose the direction you’d like them to be sorted by due date. Previously, the default sorting was done by displaying bills with due date from newest to oldest, but we’ve added in the ability to do the reverse. To sort your bills by due date from oldest to newest, simply click on the gear at the top of the table and select “Due date: Oldest to Newest.”

August 2024

(1) PO matching for NetSuite

Routable will automatically link bills in our platform with POs created in NetSuite, categorize them as expenses or items, and identify discrepancies in amounts, quantities, and prices. Combined with our industry-leading, real-time two-way sync, automating the PO matching process has never been easier.

- Automatically link bill lines with PO lines with OCR & machine learning

- Add new line items, import PO data from NetSuite, or manually link bill lines to PO lines

- Quickly review discrepancies for both expenses and inventory items

2-way PO matching for NetSuite will be available very soon with 3-way matching following quickly. PO matching for Sage Intacct is on our roadmap. Please contact success@routable.com if you’re interested in learning more.

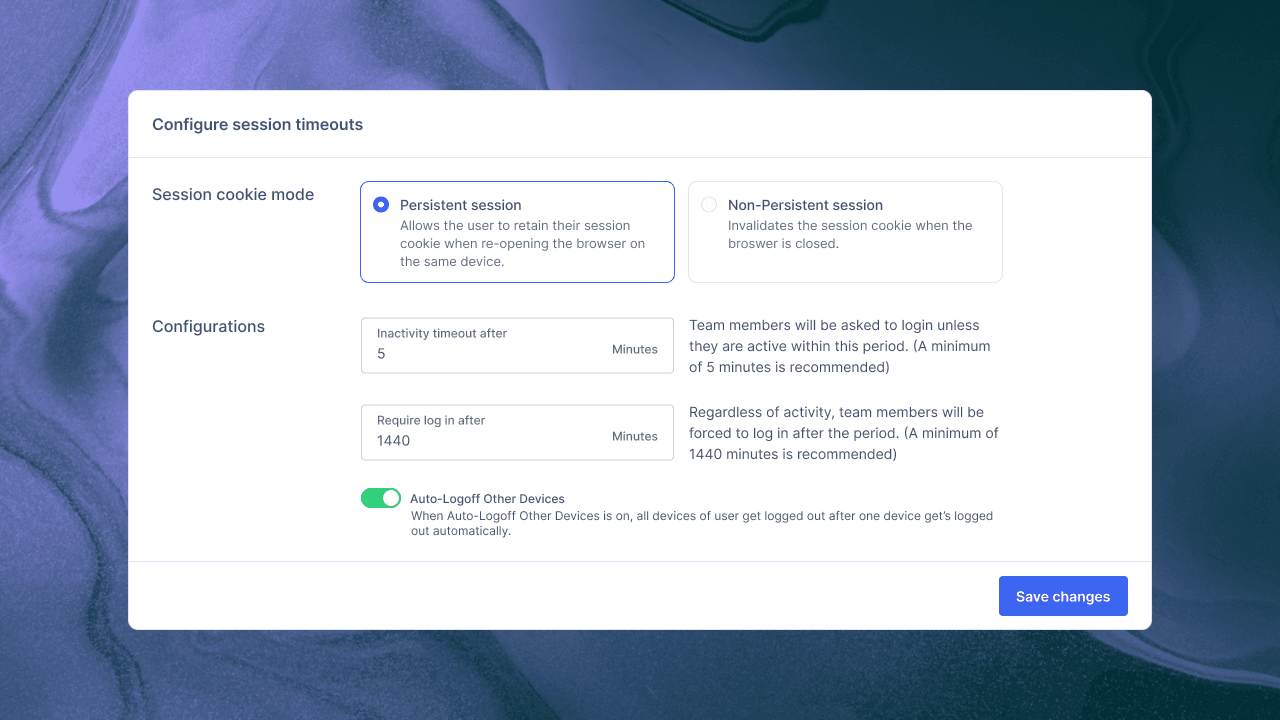

(2) Auto logout

Forgetting to log out of your Routable account can leave your company vulnerable to security risks, unauthorized access, or even fraud. In our continuing effort to keep your data, and your vendor’s data secure, we have implemented auto logout functionality.

Starting now, when a user has been inactive for a period of 2 hours or more, their user session will be automatically terminated. Please be mindful that incomplete work may not be saved upon auto log out. To avoid disruptions to your work, we advise that you not undertake large updates to things like approval workflows if you are not able to complete the updates within a single session.

To maximize the security of your account, this feature cannot be disabled. Admins, however, can submit a Support request to adjust the settings to better align with your business’s needs.

For more information about this release please visit our Help Center.

July 2024

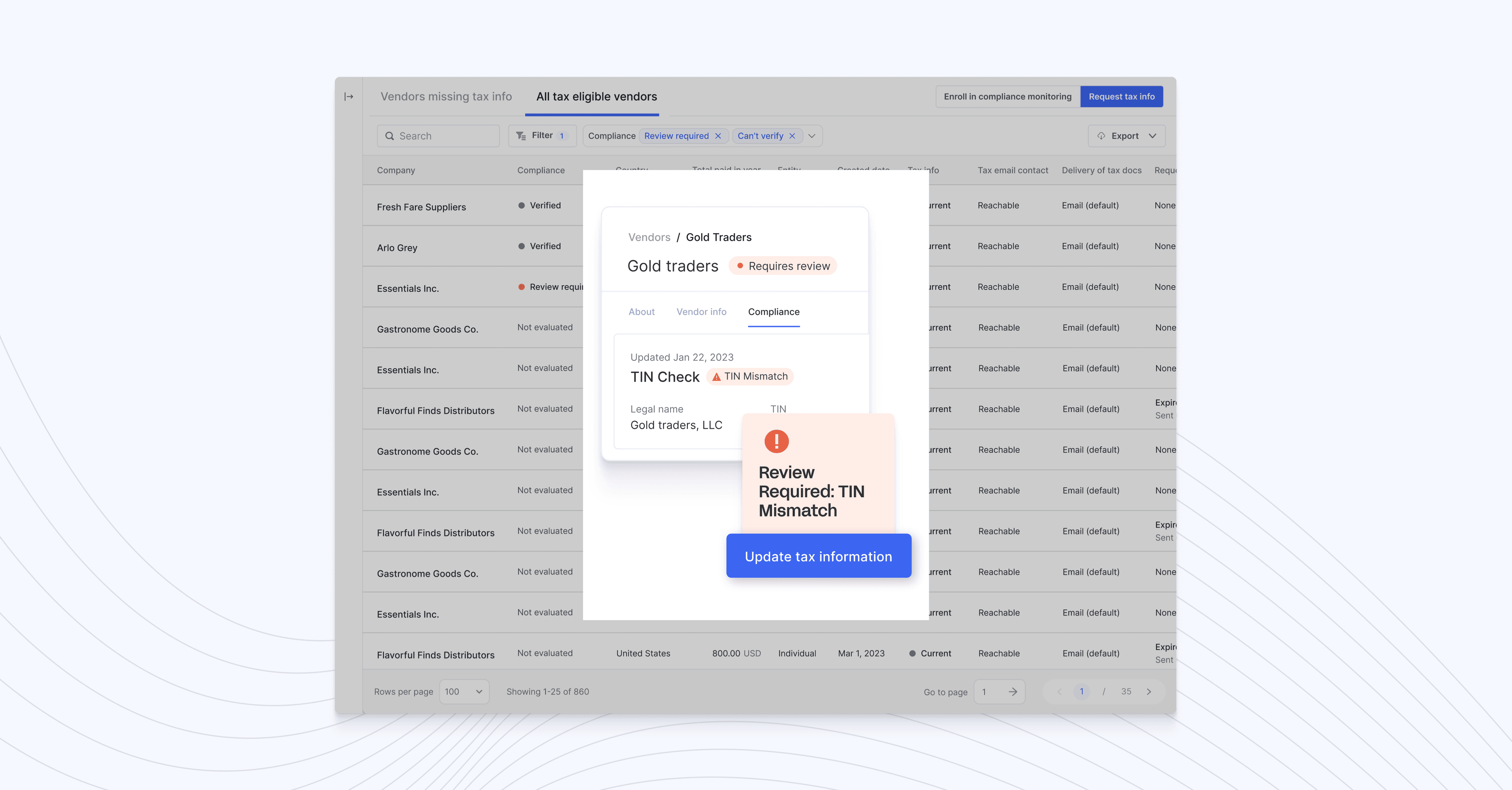

(1) Auto enroll vendors in compliance checks

We’ve added additional functionality to our Vendor Compliance Checks feature that can auto-enroll vendors in TIN and watchlist checks once they’re reached a predetermined payment threshold.

For instance, if you set your threshold at $600, you’ll ensure that you have verified tax information and confirmation of no watchlist hits for any US vendor you’ll need to send a 1099 at the end of the year.

To have Vendor Compliance Checks added to your Routable account or to set up new auto enroll workflows, please reach out to success@routable.com.

(2) Updated line item view in payable details

We’ve made additional updates to the design of the payable details page to show all line items in a table view.

This allows approvers to see all the coded details associated with each item (amount, department, location etc.), in a single view making it easier to review important information at a glance and authorize payments efficiently.

(3) New locations for Support Links

We’ve improved the location of our Support links in the Routable app.

Instead of the floating icon in the bottom right of your screen, you’ll now find links to Support on the left navigation menu while in your inbox, and in the top right of your screen when creating a new payable or receivable, or when viewing payable details.

June 2024

(1) SSO with SAML

Now, authorized users can login to their Routable account using the same set of credentials set out in your company’s security policy.

SSO in Routable works with Security Assertion Markup Language (SAML) compatible identity providers such as Microsoft Azure, Okta / Auth0, OneLogin, and more!

To learn more about enabling SSO for your Routable account, please reach out to success@routable.com.

(2) Improved vendor currency selection

Previously, when creating a vendor in Routable, the vendor’s default currency was assigned as their local currency, and synced to your accounting software that way. But, we’ve made some improvements!

Now, when creating a vendor in Routable, you can select any currency to be assigned to that vendor and it will automatically sync to your accounting software.

Want to pay a French vendor in USD? We’ve got you covered.

May 2024

(1) Vendor Compliance Checks

When creating or editing a payable, you’re now able to see uploaded attachments on the left, and bill and payment details on the right, with an expandable drawer for line items at the bottom.

With this update, you can:

- More quickly and easily create bills

- More easily review line items for accuracy

- Drag the file-viewer and line-item sections to the size you want on your screen

When creating or editing a payable, you’re now able to see uploaded attachments on the left, and bill and payment details on the right, with an expandable drawer for line items at the bottom.

With this update, you can:

- More quickly and easily create bills

- More easily review line items for accuracy

- Drag the file-viewer and line-item sections to the size you want on your screen

(3) Collapsible sidebar

When hovering over the Routable sidebar, an icon will now appear that allows you to collapse and expand. With this update, the “quick switch” functionality has also changed. Now, when you click your company name, the quick switch menu will pop up, centered on your screen.

March 2024

(1) A new view for your payables

You may have noticed that the bill and payment details page is looking a little different. That’s because we’ve revamped it to include more information from the associated bill. You’ll now see that you can easily view all of your line items with some additional details on hover.

With this update, approvers can ensure they are reviewing all of the details that were coded when the payable was created and confidently authorize payments, knowing nothing has been missed.

This release is just the first in a series of enhancements for the payable details page. We’ll keep you updated as the next improvements go live.

January 2024

(1) Assign approvers automatically by Tracking Project

Now you can assign approvers with your accounting software’s custom field, “Tracking Project” when using enterprise approval rules. Approvers in your accounting system will sync to Routable and get automatically assigned to the payable.

Visit Approval Rules in Settings, create a new rule, and select “Tracking Project” to assign approvers.

This update includes support for NetSuite, Sage Intacct, and QuickBooks Online, however project values map to the Customer field for QuickBooks Online. At this time, the Xero integration does not support this field.

December 2023

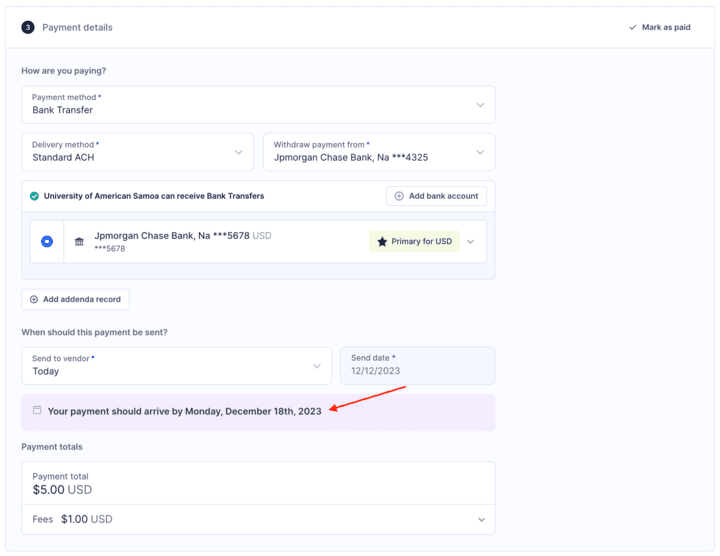

(1) Always know when funds will arrive

You can now accurately see when payments sent through Routable will arrive.

Before, when sending payments you would see a range of when the payment would arrive. We have eliminated the vagueness and now provide the exact date funds will arrive, taking into consideration banking holidays, weekends, and delivery speeds.

(2) Vendor tax filing improvements

1099-NEC and 1042-S filing

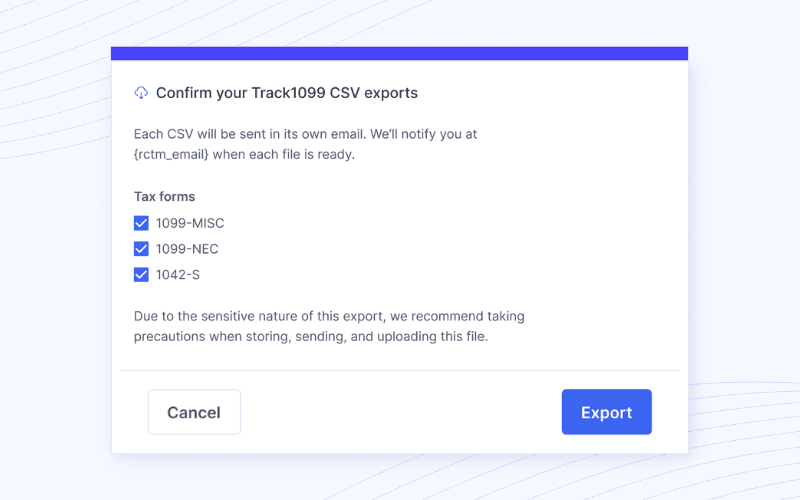

Download ready-to-go filing data for 1099 and 1042 forms, compatible with Tax1099 and Track1099. Choose which data to export with filters for 1099-NEC, 1099-MISC, and 1042-S.

1099-K Filter

Easily sort and view which of your vendors meet the 1099-K qualifications for year end filing requirements.

(3) Accounting software sync error page

We’ve introduced a new Sync Error page for clients who utilize Routable’s two-way sync with their accounting software. With this page you can:

- Easily troubleshoot errors with provided resolution steps

- Clear errors that are no longer relevant

- Resolve sync errors

To navigate to this page, click on the sidebar menu in the lower left of your screen, then select “View Sync Errors.”

November 2023

(1) Vendor tax management tools

We’ve been hard at work adding tax management functionality to the Routable platform. Recent additions and improvements include:

Tax tools center

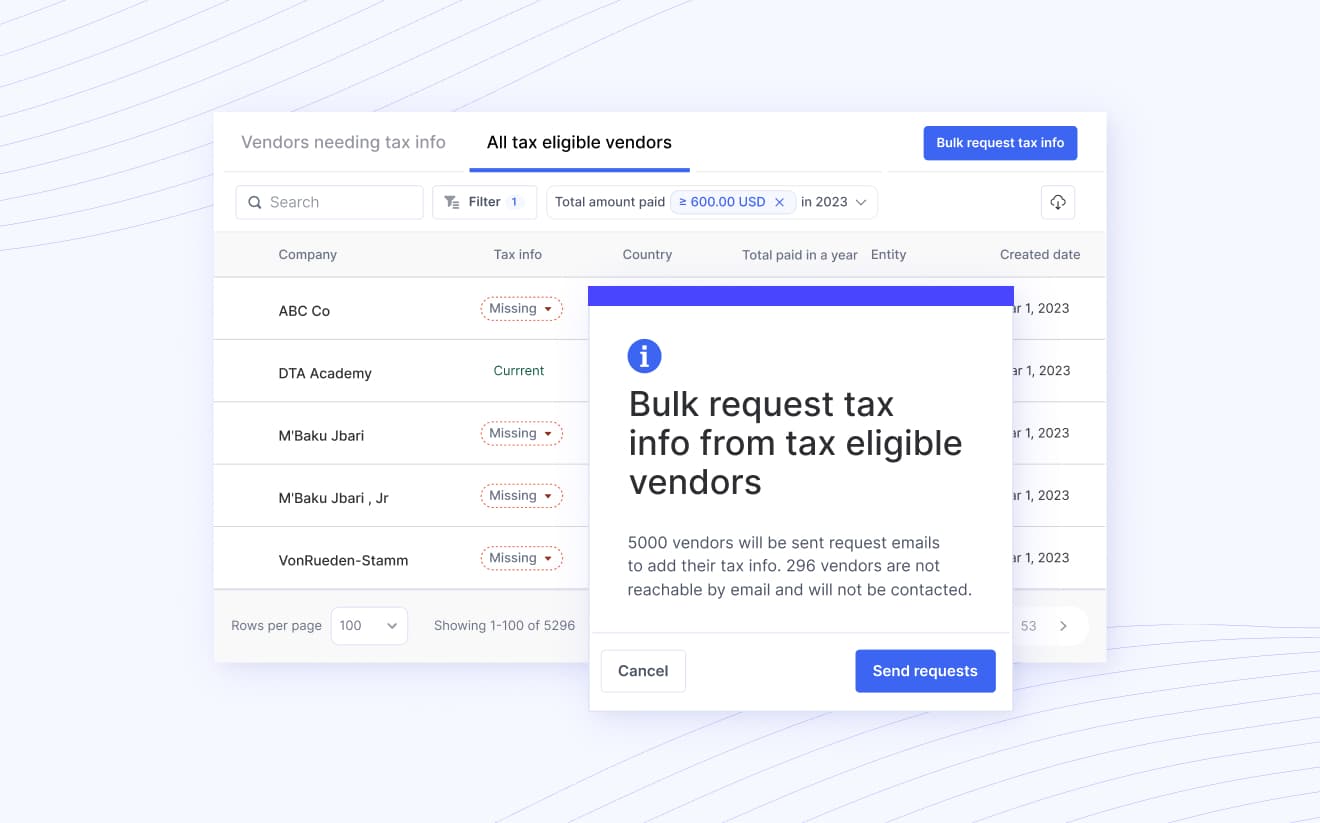

A new Tax Tools center is now available under the “Companies” drop down in the Routable dashboard. Here, you’re able to easily see all of your eligible tax vendors and any vendors whose W8/W9 you’re missing. Apply filters such as country, created date, and total amount paid to drill down to relevant vendors, then bulk request tax information from all of them with the click of a button.

And, when the time comes to export vendor 1042s and 1099s in preparation for tax filing, you can download CSV templates that allow you to make data adjustments before uploading them to your preferred E-filing system, including Tax1099 and Track1099.

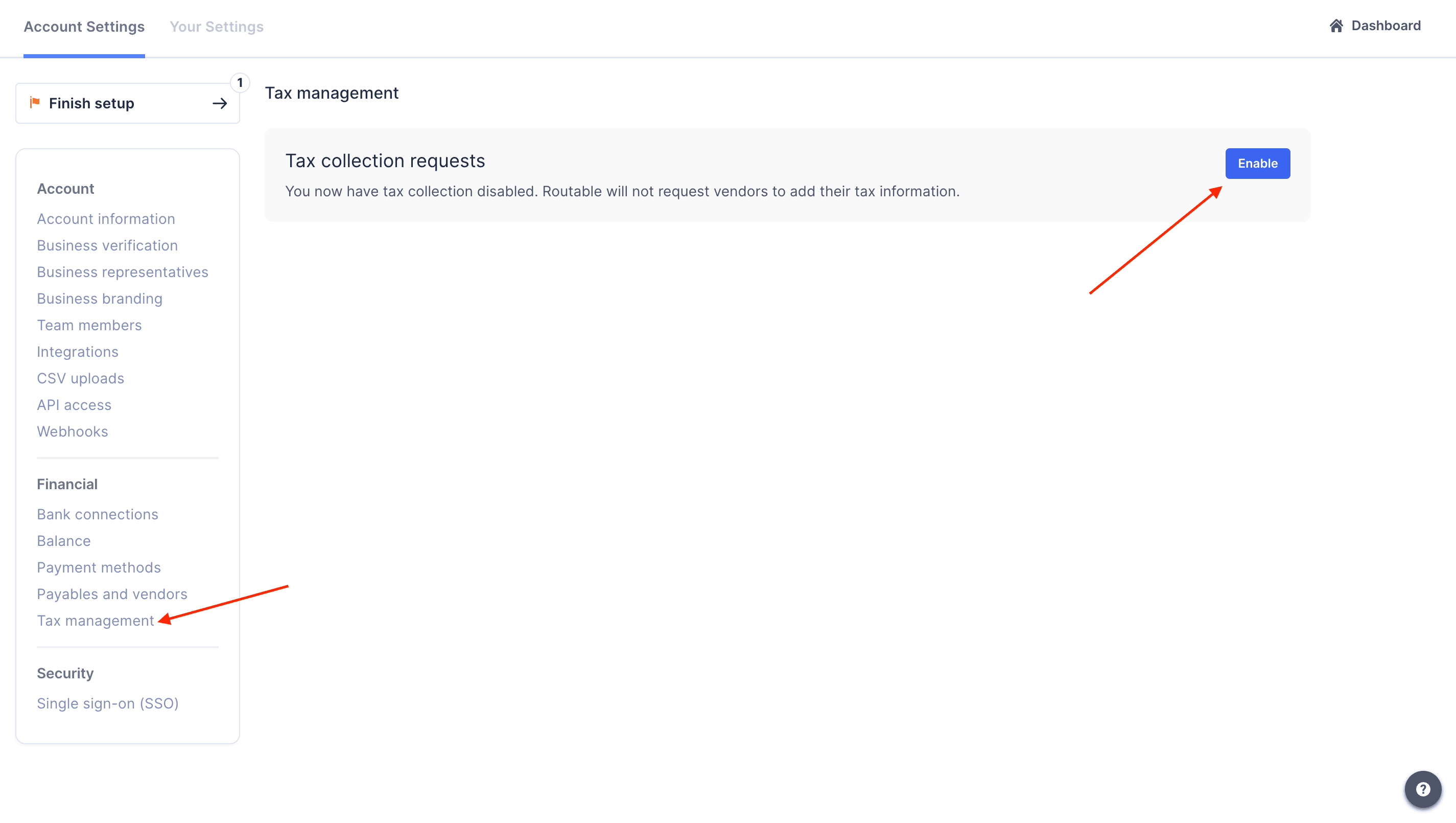

Self-serve tax settings

Match your team’s workflow and streamline vendor onboarding – Customers can now enable or disable tax collection. Tax collection enables customers to request tax information from their vendors when this setting is enabled. However, when the tax setting is disabled, customers will still have access to add tax forms in Routable.

Tax form entry

Adding to our W8/W9 collection feature, you can now enter and upload tax forms you have collected from your vendors in Routable, allowing you to have a central hub for all the tax documents you need at year end.

Collect W8 via API

Our API now supports the collection of W8 information from non-US vendors.

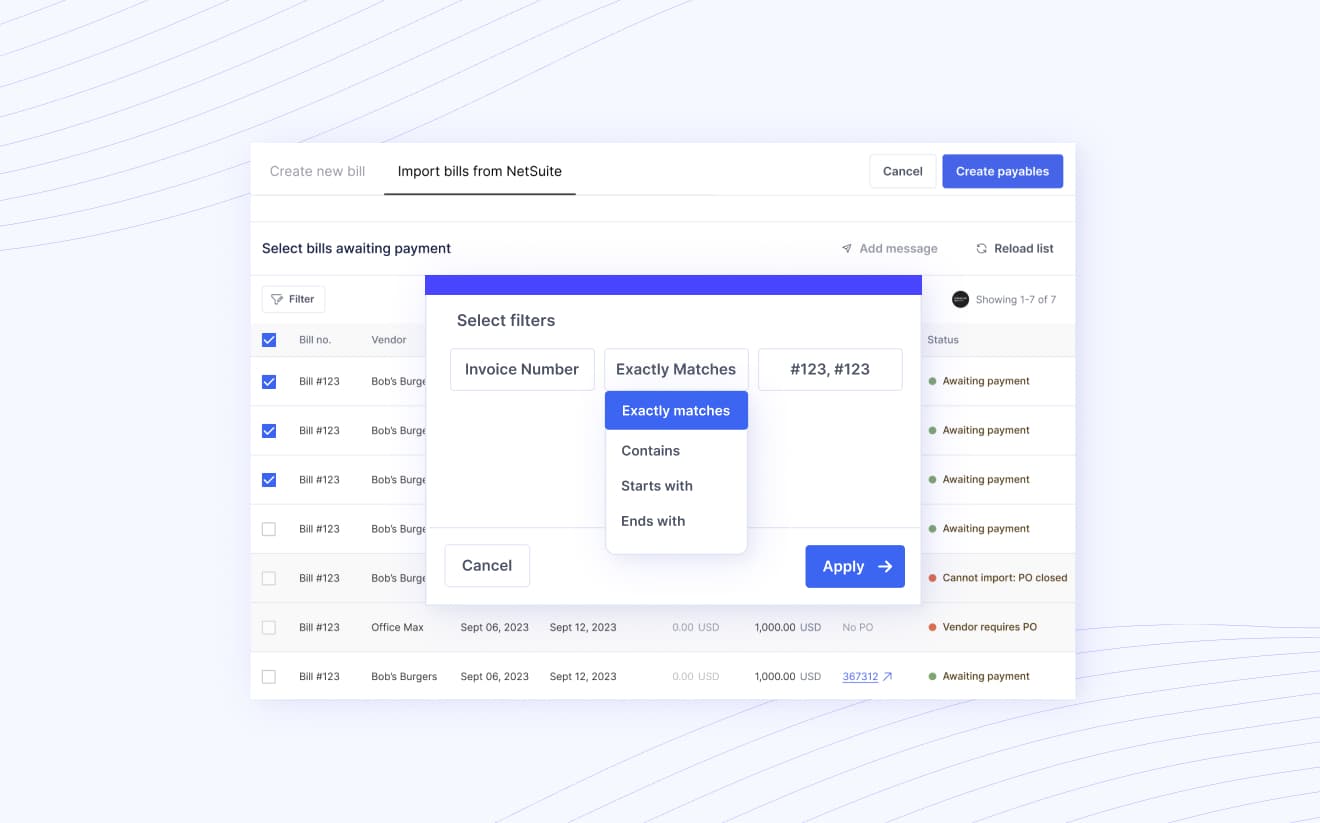

(2) Bill import bill number filter

If you use the accounting software import flow to add your payable to Routable, you now can search for bills by bill number. To search for multiple bills, you can input a comma-separated list into the search box.

(3) Use the Routable Balance with Sage Intacct

Our Sage Intacct integration now supports the Routable Balance. Make same-day and next-day payments with your Routable Balance and see those payments reflected in Intacct.

(4) Payment reference number sync for international payments

When you make an international payment, the payment reference number will be recorded on the payment transaction in your connected accounting software.

(5) API enhancements

- We’ve added several new webhooks letting you know about Company changes in Routable:

- company.created

- company.invited

- company.invitation_accepted

- payment_method.created

- tax_form.created

- We’ve deprecated the item resource, in favor of payable and receivable, to more closely match the API endpoints.

- You can now List Webhook Events directly through the API! If you need to re-fire events, want to double-check you got them all, or just view historical events, this endpoint will allow you to query and filter the list. The last 30 days of webhook data will be available through this endpoint at any given time.

September 2023

(1) Self-Serve Tax Settings

Match your team’s workflow and streamline vendor onboarding – Customers can now disable or disable tax collection. Tax collection enables customers to request tax information from their vendors when this setting is enabled. However, when the tax setting is disabled, customers will still have access to add tax forms in Routable.

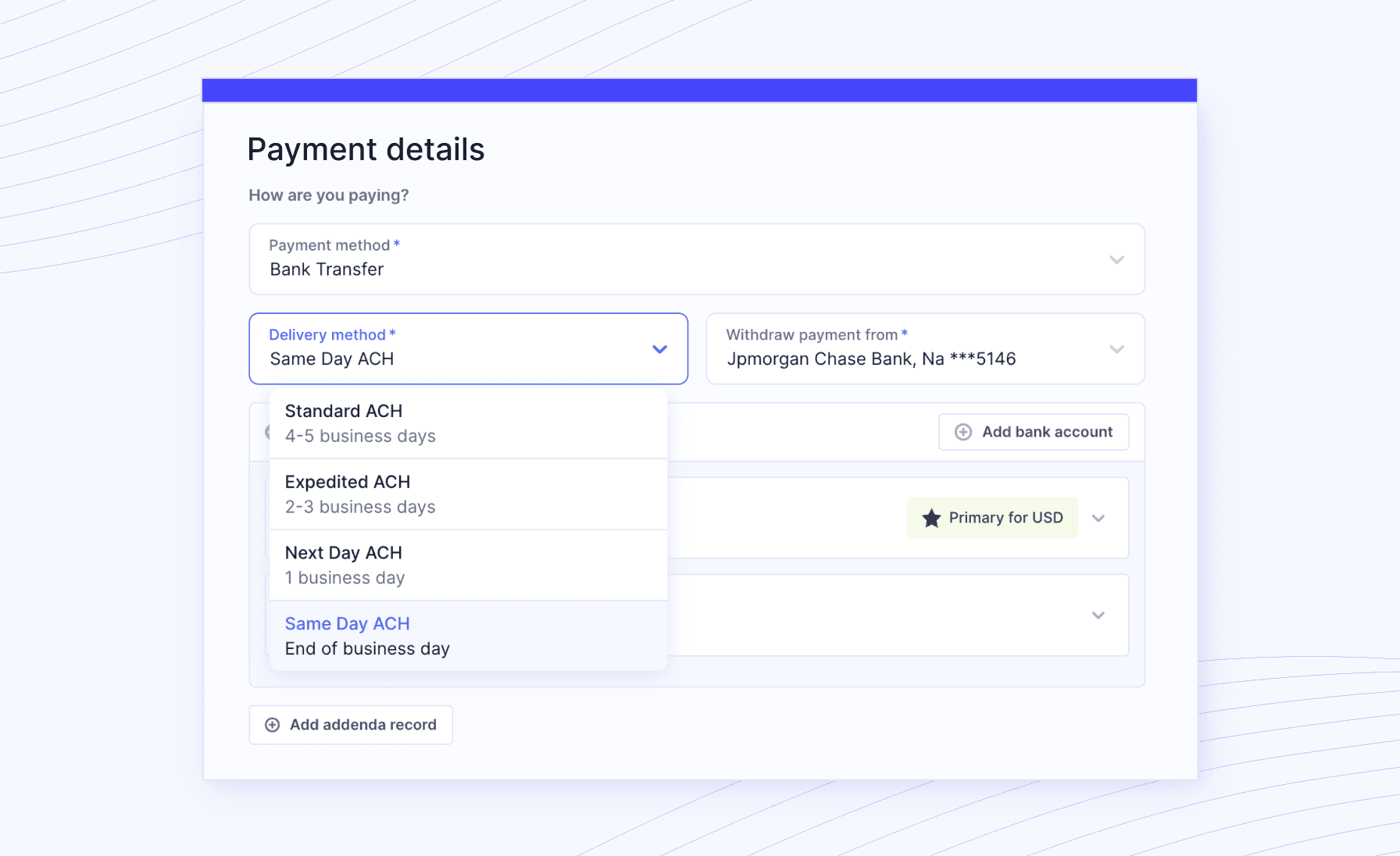

(2) Same and Next Day ACH payments funded from a bank account

Routable has long supported fast ACH payments through the Routable Balance but now, our clients have the flexibility to skip the pre-funding and send their payments *even faster* with direct transfers from their bank.

Here’s how to take advantage of this new functionality:

- When using the Routable Dashboard, simply select your bank account as the funding source instead of your Routable balance.

- When using the Routable API, use the identifier of your bank account in the `withdraw_from_account` field in the create a payable request payload.