More than half of the U.S. population has stayed away from considering life insurance because they believe it’s probably too expensive, and the most common way to buy it today is in person.

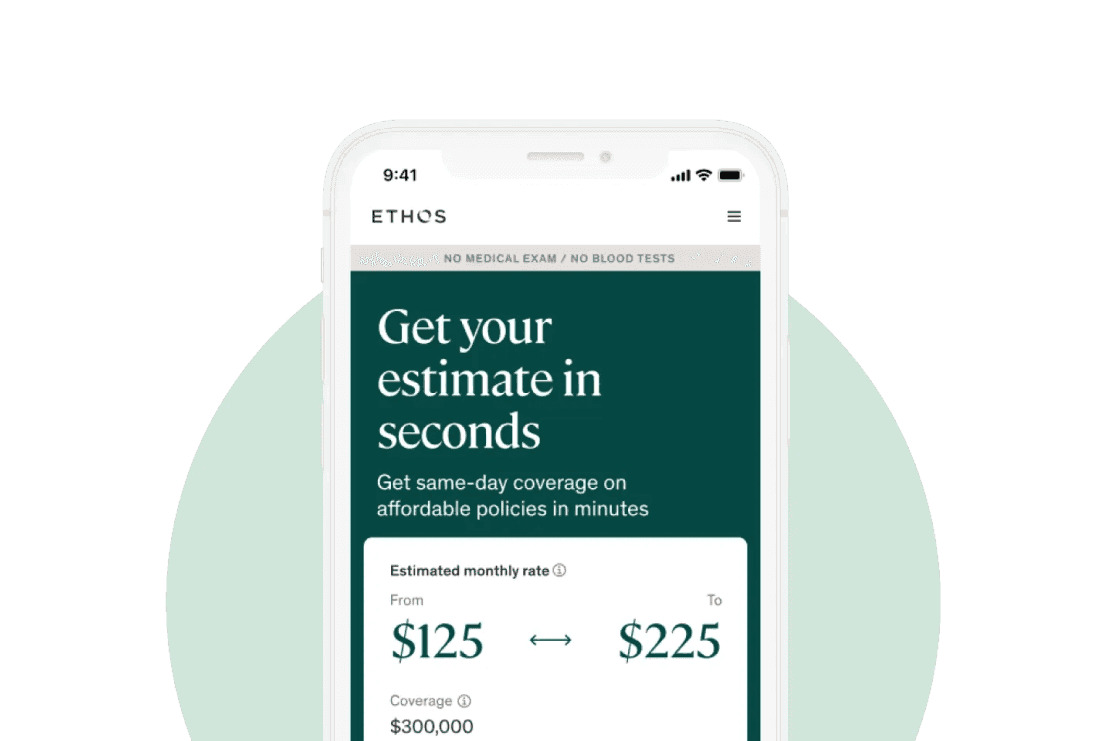

Ethos is a life insurance provider that uses advanced technology and data science to make insurance accessible to millions of families.

With a focus on creating a seamless customer experience, they have developed a mobile-first, online application process that takes only a few minutes to complete. Ethos offers coverage without requiring a medical exam for over 99% of applicants, who are only asked to answer a few health questions.

The challenge

For Ethos, BILL started breaking when they grew to code over 800 bills a month by hand. Reconciliation was taking forever, bill payments to agents weren’t properly synced to their accounting software – Oracle NetSuite – and creating visibility across 100 team members was frustrating.

Ethos is required to pay its agents commission for closing life insurance policies, and needed to find a path for scaling its business without slowing down their Finance team and operations. They needed a solution that would make approval routing seamless, increase visibility to the status of agent commission, and sync bill and payment statuses easily to reduce the time reconcile and close their books.

They also needed to solve for their projected growth, with a clear requirement to 3x their AP process in the following 12 months. After considering both Tipalti and Stripe, Ethos selected Routable to handle all of their payments.

The solution

Once on Routable their primary goal was to transfer their agents to the new platform, and run an automated vendor onboarding process.

Once their vendor base was within Routable, the Ethos team identified that they could not spend more time hand-coding bills and opted for Routable’s CSV Bulk Upload solution, which can create thousands of bills and payments in a few minutes.

Due to their continued growth, Ethos partnered with Routable’s Developer Experience team to build an automated bill, approval, and payment experience as they grew by 10x. Together, the partnership empowered Ethos to customize the information they shared with agents and reduce the amount of internal questions from team members about payment statuses, all while syncing data to NetSuite in real time.

Ethos now has a white-labeled agent solution that allows their Finance team to get back to closing the books instead of hand entering bills and remittance information.